Exhibit 99.3

Owl Rock & Dyal Merger — Frequently Asked Questions

I. Transaction Overview

1. Describe the transaction.

Owl Rock Capital Group (“Owl Rock”) and Dyal Capital Partners (“Dyal”) have signed a definitive agreement to combine in a strategic transaction that will bring together two industry leading investment platforms focused on providing capital solutions to the alternative asset management industry.

The combined business will be the surviving entity in a merger with a special purpose acquisition corporation (a “SPAC”), which will raise additional equity through a private placement, representing total cumulative cash proceeds to the SPAC of approximately $1.775 billion that it will use to facilitate the transaction. The surviving combined business, Blue Owl Capital, will be listed on the New York Stock Exchange (NYSE: OWL).

Proceeds from the transaction will be used to provide partial liquidity to Neuberger Berman, Dyal’s parent company, and certain third-party Owl Rock investors, to fund general corporate purposes, and to pay fees and expenses related to the transaction. Owl Rock’s management team will retain their existing ownership stakes and will not sell their interests in connection with the transaction.

It is expected that Owl Rock and Dyal will be led by their current respective long-tenured management and their respective investment teams will continue to employ their longstanding disciplined investment philosophies.

2. Discuss the strategic rationale for the transaction.

The transaction will bring together two industry leading investment platforms that provide capital solutions to the alternative asset management industry: Owl Rock, one of the leading direct lenders to upper middle market businesses backed by top-tier financial sponsors, and Dyal, which focuses on GP Capital Solutions, an industry Dyal has been at the forefront of since its founding. Owl Rock and Dyal will operate as distinct but complementary segments. By bringing together two preeminent franchises in these respective fields Blue Owl will be positioned as a differentiated provider of holistic solutions to the alternative asset management community. We believe this will solidify Blue Owl’s ability to offer a full suite of capital solutions to the financial sponsor community. In addition, Blue Owl is expected to benefit from the increased scale and resources that a larger, more global platform will provide.

II. Owl Rock’s Strategy and Approach

1. Will Owl Rock’s investment process or team change?

No. Owl Rock’s investment approach and process will not change. Further, there will be no changes to Owl Rock’s investment committees or investment team as a result of the transaction.

2. How will talend be retained?

We believe employees across both firms will be excited by the opportunities that the combined platform should provide. Senior management believes that Owl Rock and Dyal’s greatest assets are its teams, and expects to maintain the existing approaches to employee retention, which has proven successful, and potentially make additional enhancements.

3. Will Owl Rock’s allocation policy change?

We expect to revise our existing allocation policy to take into account the Dyal strategy and enhance our allocation procedures but we do not anticipate any material changes to Owl Rock’s allocation policy as a result of the transaction.

4. Does the merger result in any changes to Owl Rock’s managed products?

There will be no changes to the investment strategy, team or process of any entities managed by Owl Rock or its affiliates as a result of the transaction. This includes Owl Rock’s five business development companies (collectively, the “Owl Rock BDCs”) managed by registered investment advisers that are indirect subsidiaries of Owl Rock: Owl Rock Capital Corporation (NYSE: ORCC), Owl Rock Capital Corporation II, Owl Rock Capital Corporation III, Owl Rock Core Income Corp. and Owl Rock Technology Finance Corp. As discussed below, the shareholders of each Owl Rock BDC, as applicable, will be asked to approve an amended and restated investment advisory agreement between such Owl Rock BDC and its Owl Rock Adviser (as defined below) at an upcoming special meeting. All material terms will remain unchanged from the Owl Rock BDCs’ current investment advisory agreements, and such agreements, if approved by the Owl Rock BDCs’ shareholders, will become effective upon the closing of the transaction.

III. Ownership, Governance and Additional Considerations

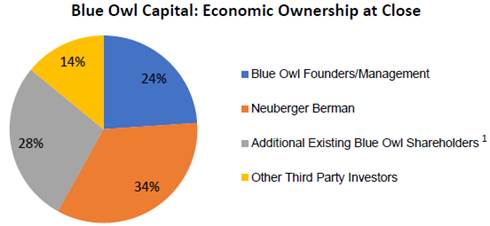

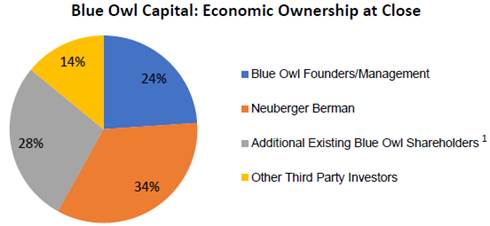

1. What is the pro forma ownership of Blue Owl Capital?

Please see below for Blue Owl Capital’s expected pro forma economic ownership breakdown:

In terms of governance, Blue Owl Capital will have a multi-share class structure. Seven individuals, comprised of four Owl Rock principals and three Dyal principals, will have “high vote” shares in Blue Owl Capital. These shares are expected to collectively control approximately 90% of the votes in Blue Owl Capital.

2. Who will be on Blue Owl Capital’s senior management team?

· Doug Ostrover, Chief Executive Officer: Previously Co-Founder, CEO and Co-Chief Investment Officer (“CIO”) of Owl Rock; former founder of GSO Capital Partners and Senior Managing Director of Blackstone

· Marc Lipschultz, Co-President: Previously Co-Founder, President and Co-CIO of Owl Rock; former KKR Management Committee Member and Global Head of Energy and Infrastructure

· Michael Rees, Co-President: Previously Managing Director and Head of Dyal; former founding employee of Neuberger Berman and Chief Operating Officer of Neuberger Bermans’ alternatives business

· Alan Kirshenbaum, Chief Financial Officer: Previously Chief Operating Officer and CFO of Owl Rock; formerly CFO of TPG Specialty Lending, Inc.

In addition, Craig Packer (Owl Rock co-CIO and co-founder) will continue as Chief Executive Officer of the Owl Rock BDCs. Alexis Maged will remain Head of Credit at Owl Rock.

3. Is anyone on Owl Rock’s management team selling their interests in the business in connection with the transaction?

No.

(1) Includes an investment made by a fund managed by Dyal Capital Partners.

4. Who is expected to comprise Blue Owl Capital’s Board of Directors?

Blue Owl Capital’s nine person Board of Directors is expected to be comprised of three independent directors, three Owl Rock-appointed directors, two Dyal-appointed directors, and one Neuberger Berman-appointed director.

5. Identify the specialty purpose acquisition corporation team and describe their role.

The SPAC, Altimar Acquisition Corp. (NYSE: ATAC-UN), is sponsored by HPS Investment Partners. The merger is subject to a mandatory shareholder vote, requiring a 50% majority and sponsor commitment to vote “yes.” If the merger is approved by the SPAC’s shareholders, the business combination of Owl Rock, Dyal and the SPAC will be consummated with Blue Owl Capital as the surviving entity. Thereafter, SPAC management will have a de minimis equity position in the resulting publicly traded entity, Blue Owl Capital. The existing SPAC management will not have any role in management or on the board of directors of Blue Owl Capital.

6. Describe Neuberger Berman’s involvement in the transaction.

As part of the transaction Neuberger Berman will be selling a portion of its preexisting ownership stake in Dyal. Neuberger Berman will retain a large stake in Blue Owl Capital upon completion of the transaction and will have a board seat on Blue Owl Capital’s board.

7. What happens to Dyal Fund IV’s minority interest in Owl Rock as a result of the transaction?

Dyal Fund IV, a fund managed by Dyal, previously acquired a minority, non-voting interest in Owl Rock. Pro forma for the transaction Dyal Fund IV will own an interest in Blue Owl Capital and will be managed by Blue Owl Capital.

8. When will the transaction close?

The transaction was formally announced on December 23, 2020 and we expect it to close in 1H’21 subject to satisfaction of a number of terms and conditions. The Transaction is subject to, among other closing conditions, approval by the SPAC shareholders, approval of the equityholders of each of the Owl Rock BDCs to the assignment of its advisory agreement, and the approval of Dyal’s Limited Partners.

9. How are the investors of Owl Rock’s managed BDCs and funds involved in the transaction?

Consummation of the transaction will result in a change of control of the registered investment adviser to each of the Owl Rock BDCs (the “Owl Rock Advisers”) under the Investment Company Act of 1940, as amended (the “1940 Act”), which will result in the assignment of each Owl Rock BDC’s current investment advisory agreement in accordance with the 1940 Act. As a result, the shareholders of each Owl Rock BDC, as applicable, will be asked to approve an amended and restated investment advisory agreement between such Owl Rock BDC and its Owl Rock Adviser at an upcoming special meeting. The amended and restated investment advisory agreements will replace the current investment advisory agreement upon the consummation of the transaction.

All material terms will remain unchanged from the Owl Rock BDCs’ current investment advisory agreements, and such agreements, if approved by the Owl Rock BDCs’ shareholders, will become effective upon the closing of the transaction.

In addition, limited partners in Owl Rock’s private funds will be required to provide consent for the transaction in accordance with their fund documentation. Owl Rock will be in communication with the respective investors of each managed product with additional details on these processes and their timing.

10. Who can I call with questions?

Please contact your Owl Rock representative or call Owl Rock’s sales desk at (212) 419-3000 for additional information.

Forward Looking Statements

Some of the statements contained herein may include “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than historical facts, including but not limited to statements regarding the expected timing of the transaction; the expected benefits of the transaction; and any assumptions underlying any of the foregoing, are forward-looking statements. Forward-looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “predict,” “continue,” “target” or other similar words or expressions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove to be incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond the control of Owl Rock Capital Corporation (NYSE: ORCC), Owl Rock Capital Corporation II, Owl Rock Capital Corporation III, Owl Rock Core Income Corp. and Owl Rock Technology Finance Corp. (collectively, the “Owl Rock BDCs”) and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements including, without limitation, the risks, uncertainties and other factors identified in the Owl Rock BDCs’ filings with the Securities and Exchange Commission (the “SEC”). Investors should not place undue reliance on these forward-looking statements, which apply only as of the date on which such Owl Rock BDC makes them. The Owl Rock BDCs do not undertake any obligation to update or revise any forward-looking statements or any other information contained herein, except as required by applicable law.

Additional Information and Where to Find It

In connection with this transaction which will result in the change in control of the Owl Rock Advisers, the applicable Owl Rock BDCs intend to file proxy statements in preliminary and definitive form with the SEC that will contain important information about the proposed transaction and related matters, and deliver a copy of the proxy statement to its shareholders. INVESTORS OF THE OWL ROCK BDCs ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors may obtain a free copy of these materials when they are available and other documents filed by the Owl Rock BDCs with the SEC at the SEC’s website at www.sec.gov or at Owl Rock’s website at www.owlrock.com or www.owlrock.com/proxy/ or, for Owl Rock Capital Corporation, at

www.owlrockcapitalcorporation.com. Investors and security holders may also obtain free copies of the proxy statement and other documents filed with the SEC from the Owl Rock BDCs by contacting Investor Relations at (212) 651-4705.

Participants in the Solicitation

The applicable Owl Rock BDCs and their directors, executive officers, employees and other persons may be deemed to be participants in the solicitation of proxies from the shareholders of the applicable Owl Rock BDCs’ common stock in respect of the change in control transaction. For information regarding the Owl Rock BDCs’ directors and executive officers, please see: Owl Rock Capital Corporation’s definitive proxy statement filed with the SEC on April 17, 2020, in connection with its 2020 annual meeting of shareholders; Owl Rock Capital Corporation II’s definitive proxy statement filed with the SEC on April 17, 2020, in connection with its 2020 annual meeting of shareholders; Owl Rock Technology Finance Corp.’s definitive proxy statement filed with the SEC on April 17, 2020, in connection with its 2020 annual meeting of shareholders; Owl Rock Capital Corporation III’s registration statement on Form 10 filed with the SEC on July 17, 2020. Other information regarding persons who may be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC when they become available.

Owl Rock Capital Securities LLC is a member of FINRA/SIPC.