Merger of Owl Rock Capital Group and Dyal Capital Partners December 2020 Blue Owl Overview

Merger of Owl Rock Capital Group and Dyal Capital Partners December 2020 Blue Owl Overview

Disclaimers This Investor Presentation is for informational purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other financial instrument of any of Owl Rock, Dyal or the Company in any jurisdiction in which the offer, solicitation, recommendation or sale would be unlawful. The information contained herein does not purport to be comprehensive. The data contained herein is derived from various internal and external sources, which has not been independently verified by Owl Rock, Dyal or the Company. No representation is made as to the reasonableness of the assumptions underlying, or the accuracy or completeness of any, modeling or back-testing or any other information contained herein. All levels, prices and spreads are historical and do not represent current market levels, prices or spreads, some or all of which may have been changed since the issuance of this document. Any data on past performance, modeling or back-testing contained herein is not an indication as to future performance. Use of Projections This Investor Presentation contains financial forecasts or projections with respect to Dyal, Owl Rock or the Company. Projected performance with respect to Dyal, Owl Rock, the Company, the investment vehicles they manage or expect to manage, and the investments such vehicles make or expect to make is provided on a pro forma basis and is based on certain good faith assumptions that Dyal and Owl Rock believe are reasonable (including, without limitation, estimates and targets of future operating results or cash flows). The actual performance will depend on, among other factors, future operating results, including of the investment vehicles and their portfolio companies, the value of certain assets and market conditions at the time of establishment, acquisition or disposition, any related transaction costs, and time and manner of establishment, acquisition and disposition, all of which may differ from the underlying assumptions on which the projected performance data contained herein are based. In addition, there are many risk factors that could cause Dyal and Owl Rock’s assumptions to prove to be incorrect. These risks therefore could cause the actual performance of the Company to be materially different from the current projected, targeted or estimated performance. These projections are provided solely for illustrative purpose, and there can be no assurances that any projections or targets will ultimately be realized, in the manner illustrated herein or at all. No independent registered public accounting firm of Dyal, Owl Rock or the Company has audited, reviewed, compiled, or performed any procedures with respect to the financial forecasts or projections for the purpose of their inclusion in this Investor Presentation, and accordingly, none of them expresses an opinion or provides any other form of assurance with respect thereto for the purpose of this Investor Presentation. These financial forecasts and projections should not be relied upon as being necessarily indicative of future results. Forward Looking Statements This Investor Presentation includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements include estimated financial information. Such forward looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the businesses of the Company are based on current expectations that are subject to risks and uncertainties, including those described below. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. Investing in unseasoned companies and in sponsors of alternative investment platforms carries significant risk. Operating results in a specified period will be difficult to predict. The performance of Dyal and Owl Rock, and thus the Company, will depend upon their success in structuring, distributing and operating alternative investment vehicles, including current and potential future vehicles, which will impact the operating results of each of Dyal, Owl Rock, the Company, the investment vehicles they manage or expect to manage, and the investments such vehicles make or expect to make are and will be subject to various risks relating to such entities’ operations, including, but not limited to: weaker-than anticipated market acceptance of products and services; disruptions in technology development; an inability to successfully manage expanding operations; an inability to attract and retain key management and technical personnel; competition posed by established enterprises; changes in accounting rules or government regulation; weakness in the applicable industries as well as the U.S. and global economy; currency fluctuations; and the effects of other geopolitical events. Each of Dyal, Owl Rock, the Company, the investment vehicles they manage or expect to manage, and the investments such vehicles make or expect to make is subject to the ongoing effects of the COVID-19 pandemic, the impact of which is particularly difficult to forecast. Because all forward-looking statements involve risks and uncertainties, actual results of the Dyal, Owl Rock and the Company may differ materially from any expectations, projections or predictions made or implicated in such forward-looking statements. Prospective investors are therefore cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date made. None of Owl Rock, Dyal or the Company commits to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

Transaction Summary

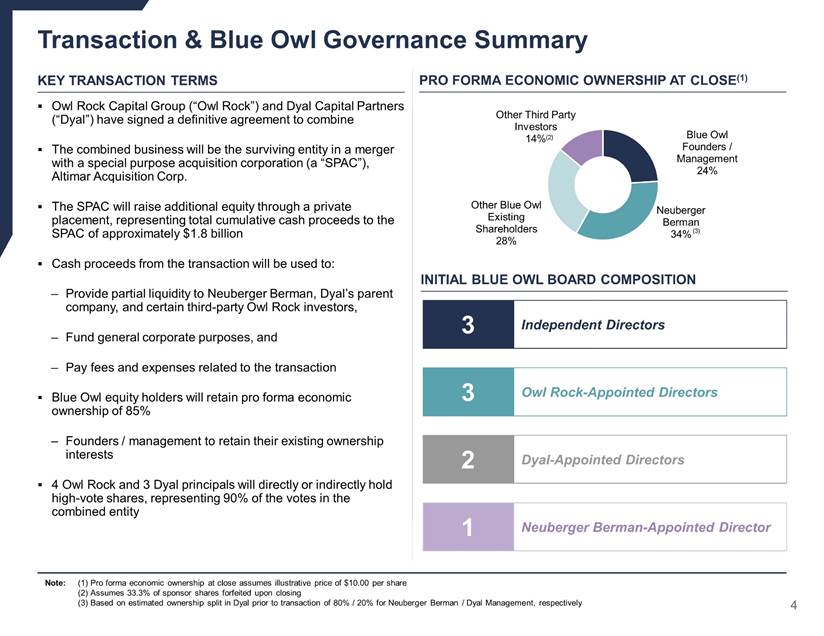

Transaction & Blue Owl Governance Summary Key transaction terms Owl Rock Capital Group (“Owl Rock”) and Dyal Capital Partners (“Dyal”) have signed a definitive agreement to combine The combined business will be the surviving entity in a merger with a special purpose acquisition corporation (a “SPAC”), Altimar Acquisition Corp. The SPAC will raise additional equity through a private placement, representing total cumulative cash proceeds to the SPAC of approximately $1.8 billion Cash proceeds from the transaction will be used to: Provide partial liquidity to Neuberger Berman, Dyal’s parent company, and certain third-party Owl Rock investors, Fund general corporate purposes, and Pay fees and expenses related to the transaction Blue Owl equity holders will retain pro forma economic ownership of 86% Founders / management to retain their existing ownership interests 4 Owl Rock and 3 Dyal principals will directly or indirectly hold high-vote shares, representing 90% of the votes in the combined entity Note: (1) Pro forma economic ownership at close assumes illustrative price of $10.00 per share (2) Assumes 33.3% of sponsor shares forfeited upon closing (3) Based on estimated ownership split in Dyal prior to transaction of 80% / 20% for Neuberger Berman / Dyal Management, respectively Pro forma economic ownership at close(1) (2) (3) Independent Directors 3 Owl Rock-Appointed Directors 3 Dyal-Appointed Directors 2 Neuberger Berman-Appointed Director 1 Initial Blue Owl board composition Blue Owl Founders / Management 24% Neuberger Berman 34% Other Blue Owl Existing Shareholders 28% SPAC Shares 2% PIPE Shares 12% Sponsor Shares 0.4%

Implications for Owl Rock BDCs

Implications for Owl Rock BDCs The closing of the merger will result in a deemed change in control of the advisor(s) to Owl Rock’s managed BDCs (the “Owl Rock BDCs”) As a result, shareholders of Owl Rock’s managed BDCs, as applicable, will be asked to approve an amended and restated investment advisory agreement All material terms will remain unchanged from the Owl Rock BDCs’ current investment advisory agreements Investor Proxy Timeline Owl rock Managed BDC Impact No Change to the Investment Team Team No Change to the Investment Process Process No change to the Investment Committee BDC IC No change to Investment Terms Terms Merger Announcement: December 23, 2020 1 Proxy Voting Starts: January 2021 2 Transaction Closes: First Half 2021 4 Shareholder Meeting: March 2021 3

III. Blue Owl Platform Highlights

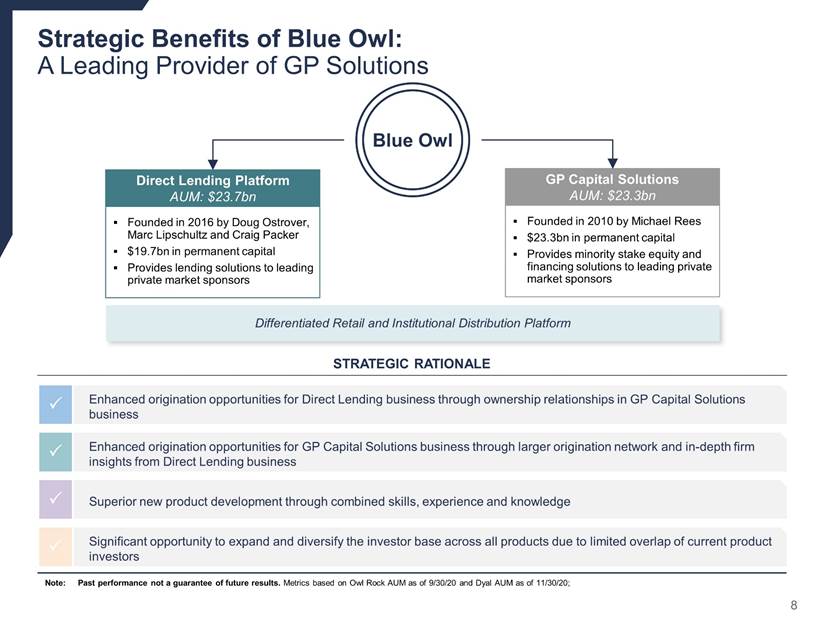

Strategic Benefits of Blue Owl: A Leading Provider of GP Solutions Note: Metrics based on Owl Rock AUM as of 9/30/20 and Dyal AUM as of 11/30/20; Dyal AUM includes $1.4bn of closed commitments from Fund V Blue Owl Direct Lending Platform AUM: $23.7bn GP Capital Solutions AUM: $23.3bn Founded in 2016 by Doug Ostrover, Marc Lipschultz and Craig Packer $19.7bn in permanent capital Provides lending solutions to leading private market sponsors Founded in 2010 by Michael Rees $23.3bn in permanent capital Provides minority stake equity and financing solutions to leading private market sponsors strategic rationale Enhanced origination opportunities for Direct Lending business through ownership relationships in GP Capital Solutions business Enhanced origination opportunities for GP Capital Solutions business through larger origination network and in-depth firm insights from Direct Lending business Significant opportunity to expand and diversify the investor base across all products due to limited overlap of current product investors P P P Superior new product development through combined skills, experience and knowledge P Differentiated Retail and Institutional Distribution Platform

Blue Owl is a Preeminent Provider of Private Market GP Solutions Deep relationships facilitate a differentiated ecosystem to deliver GP solutions Note: Metrics based on Owl Rock AUM as of 9/30/20 and Dyal AUM as of 11/30/20 (1) Includes closed commitments from Fund V of $1.4bn as of November 2020 BROAD range of capital solution strategies & Extensive network of relationships Portfolio Companies Fund Solutions GP Solutions Diversified Lending First Lien Lending Technology Lending Opportunistic Lending Co-Investments Secondary Solutions GP Lending GP Stakes AUM: $15.2bn AUM: $2.9bn AUM: $4.5bn AUM: $1.1bn To launch To launch AUM: $1.0bn AUM: $22.3bn(1) Advent International Global Private Equity Altamont Capital Partners American Securities Aquiline Capital Partners Arcmont Asset Management Audux Group Bain Capital Private Equity Berkshire Partners Bridgepoint Advisers Cerberus Capital Management Clayton, Dubilier & Rice Clearlake Capital Group Cross Harbor Capital Partners Francisco Partners Genstar Capital Golden Gate Capital Goldman Sachs GTCR Private Equity HG Capital HGGC HLG Capital I Squared Capital KKR & Co Kohlberg & Company KPS Capital Partners L Catterton MSD Capital New Mountain Capital Odyssey Investment Partners ONEX Corporation Platinum Equity Providence Equity Partners RXR Realty Silver Lake Partners SoftBank Starwood Capital Group Summit Partners TA Associates Thoma Bravo Towerbrook Capital Partners TPG Capital TSG Consumer Partners Vector Capital Veritas Capital Vista Equity Partners Warburg Pincus

Senior Leadership Doug Ostrover CEO Co-Founder and CEO of Owl Rock Capital Partners and a member of the Advisors’ Investment Committee Co-CIO of Owl Rock Capital Advisors Prior to founding Owl Rock, was one of the founders of GSO Capital Partners and a Senior Managing Director at Blackstone 25+ years of experience Marc Lipschultz Co-President Co-Founder and President of Owl Rock Capital Partners Co-CIO of Owl Rock Capital Advisors Prior to founding Owl Rock, spent more than two decades at KKR, serving on the firm’s Management Committee and as the Global Head of Energy and Infrastructure 25+ years of experience Michael Rees Co-President Managing Director and Head of Dyal Capital Partners and a member of Neuberger Berman’s Partnership Committee Prior to founding Dyal, was a founding employee and shareholder of Neuberger Berman Group and the first Chief Operating Officer of the NB Alternatives business 20+ years of experience Alan Kirshenbaum CFO Chief Operating Officer & Chief Financial Officer of Owl Rock Capital Partners, ORCC, ORTF and Owl Rock Capital Advisors, as well as the Chief Operating Officer of ORCC III Prior to Owl Rock, was the CFO of TPG Specialty Lending, Inc. 25+ years of experience

Business Overviews

Direct Lending Key Highlights Blue Owl is one of the leading direct lending platforms managed by a seasoned executive team Scale Robust proprietary deal flow driven by an extensive network of sponsors Significant backing from highly sophisticated investors Deep bench of experienced investment professionals $23.7bn Assets Under Management Track Record Demonstrated ability to source proprietary investment opportunities with $24bn in originations Strong credit performance across the platform with below market payment defaults Successfully listed Owl Rock Capital Corporation (“ORCC”) on NYSE(1) 11.8% IRR on Realized Investments Since Inception Alignment Not affiliated with a controlling equity sponsor Entire investment team is focused on direct lending Relationship-oriented approach at all levels $465m+ Owl Rock Executive and Employee Capital Commitments Experience Founders: Douglas Ostrover, Marc Lipschultz and Craig Packer Senior executive roles at GSO / Blackstone, KKR and Goldman Sachs Extensive experience building and managing investment businesses 25+ Each of Co-Founder’s Years of Experience Note: As of 9/30/20. Direct Lending does not include Dyal Financing Fund, which is included in GP Capital Solutions. Past performance is not a guarantee of future results. Internal Rate of Return (“IRR”) only reflects fully realized investments for Owl Rock’s diversified lending, first lien and technology lending strategies and would be different (and potentially higher or lower) if the IRR on unrealized investments were factored into the calculations. In addition, as the IRR shown only represents the IRR on investments, it does not include the impact of management and incentive fees or fund level expenses, including taxes, which would be borne by Owl Rock funds or their shareholders. As such an actual investor in the Owl Rock Funds would have achieved an IRR on its realized investments lower than the one shown (1) Listed on 7/17/19

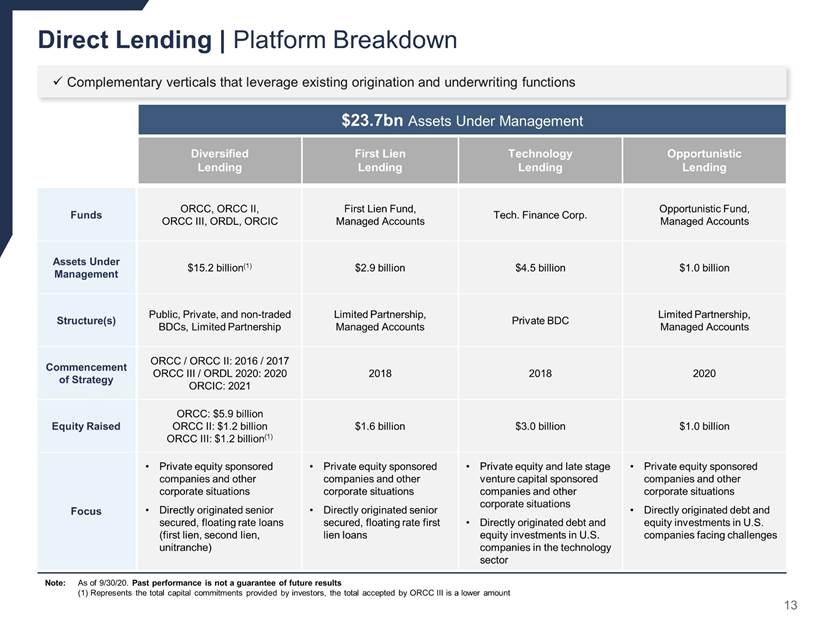

Complementary verticals that leverage existing origination and underwriting functions Direct Lending Platform Breakdown Note: As of 9/30/20. Past performance is not a guarantee of future results (1) Represents the total capital commitments provided by investors, the total accepted by ORCC III is a lower amount $23.7bn Assets Under Management Diversified Lending First Lien Lending Technology Lending Opportunistic Lending Funds ORCC, ORCC II, ORCC III, ORDL, ORCIC First Lien Fund, Managed Accounts Tech. Finance Corp. Opportunistic Fund, Managed Accounts Assets Under Management $15.2 billion(1) $2.9 billion $4.5 billion $1.1 billion Structure(s) Public, Private, and non-traded BDCs, Limited Partnership Limited Partnership, Managed Accounts Private BDC Limited Partnership, Managed Accounts Commencement of Strategy ORCC / ORCC II: 2016 / 2017 ORCC III / ORDL 2020: 2020 ORCIC: 2021 2018 2018 2020 Equity Raised ORCC: $5.9 billion ORCC II: $1.2 billion ORCC III: $1.2 billion(1) $1.6 billion $3.0 billion $1.0 billion Focus Private equity sponsored companies and other corporate situations Directly originated senior secured, floating rate loans (first lien, second lien, unitranche) Private equity sponsored companies and other corporate situations Directly originated senior secured, floating rate first lien loans Private equity and late stage venture capital sponsored companies and other corporate situations Directly originated debt and equity investments in U.S. companies in the technology sector Private equity sponsored companies and other corporate situations Directly originated debt and equity investments in U.S. companies facing challenges

GP Capital Solutions Key Highlights Blue Owl is a leading provider of capital solutions to private markets managers Long-Term Partner Permanent capital enables formation of stable, value-added partnerships 34-person Business Services Platform team collaborates with partner managers to achieve their unique business goals by offering a range of advisory services and capital strategies to support growth 100% Permanent Capital Note: (1) As of 11/30/20; Includes closed commitments of $1.4bn from Fund V as of November 2020 Size & Scale Strong and extensive relationships across the alternative asset management ecosystem Large base of stable capital facilitates partnership with leading alternative managers Recognized as a market leader in the GP-stake universe $23.3bn Assets Under Management(1) Experience Founder: Michael Rees Average 18 years of experience across senior management team Completed 57 equity and debt transactions across 49 managers 10+ Years of Team Experience Executing Minority Partnership Strategy

Complementary strategies providing a range of solutions to capital-constrained ecosystems GP Capital Solutions Platform Breakdown Existing strategies Newly launched strategies Alternative manager Gp stakes Private equity GP Financing Co-investments & structured equity Professional Sports minority Stakes Funds Funds I-V Financing Fund (DFF) Strategic Capital HomeCourt Partners mandate Funds I-II: Primarily hedge fund minority stakes Funds III-V: Primarily private equity minority stakes Long-term financing to private alternative asset managers Minority equity investments in portfolio companies of private equity partners NBA franchise minority equity stakes Structure Closed-End Permanent Capital Fund Open-Ended Permanent Capital Fund Open-Ended Permanent Capital Fund Open-Ended Permanent Capital Fund Committed capital / Initial Investment Capacity $19.2bn(1) Expected Initial Investment Capacity of $3.0bn Expected Initial Investment Capacity of $3.0bn Expected Initial Investment Capacity of $2.0bn Commencement of Strategy 2010 2019 # of Partnerships 49 3 Note: Strategic Capital and HomeCourt Partners are expected new strategies of the Dyal business. There can be no assurance that such strategies will launch as expected (1) Includes closed commitments from Fund V of $1.4bn as of November 2020; excludes co-investments