Exhibit 99.2

OWL ROCK CAPITAL CORPORATION www.OwlRockCapitalCorporation.com Update on Board of Directors Approval of Reduced Asset Coverage April 2020

NYSE: ORCC │ 2 ORCC’S RATIONALE FOR REDUCING ASSET COVERAGE ▪ On March 31, 2020, the ORCC Board of Directors unanimously approved the reduction of ORCC’s minimum asset coverage ratio from 200% to 150%. ▪ This step should enhance our ability to deliver strong returns to shareholders while continuing to prudently manage risk and maintain a very strong balance sheet. ▪ It will also give us increased flexibility and capacity to continue to employ our strategy of originating high - quality, middle and upper - middle market loans. ▪ All of our investment grade peers have already moved to reduce their asset coverage ratio; we are the last to do so. ▪ Since we have been operating well below our target leverage profile of 0.75x this has not previously been a priority for us, but we believe it is prudent for us to have the same flexibility as our peers. ▪ Our balance sheet is well matched from a duration perspective, our financings are diversified across facilities and lenders, and we have a robust liquidity position that includes $2.0 billion of cash and undrawn debt capacity. ▪ We believe our plan will continue to result in an investment grade funding profile and operating with an increased cushion to the regulatory limit is a prudent approach from a risk management perspective. ▪ From the inception of ORCC, we have worked hard to build a strong reputation and track record with our important stakeholders including our equity investors, lenders, bondholders and rating agencies and feel we are now ready to take this step. We intend to operate in a manner that we believe will maintain ORCC’s investment grade ratings while generating an incremental increase in annual earnings for our stockholders, as well as maintain our direct origination strategy, with no change to our investment philosophy This proposed reduction in the asset coverage ratio is not being driven by recent changes in the market and economic environment, but rather is part of the natural evolution of ORCC’s balance sheet over the last several years

NYSE: ORCC │ 3 ORCC’S PLAN FOR REDUCING THE ASSET COVERAGE REQUIREMENT Operate with increased cushion to the regulatory limit, reducing risk for the Company and stakeholders Continue our highly selective and disciplined, risk - averse investment approach Maintain investment grade credit ratings Modestly expand leverage by targeting 0.9x – 1.25x debt to equity Maintain market leadership and competitive positioning among industry peers We expect our plan will generate incremental earnings while maintaining our defensive investment posture and conservative leverage profile No change to our direct origination strategy, investment philosophy and senior secured portfolio orientation The Key Elements of Our Plan Reduce base management fee to 1.0% on assets financed with leverage over 1.0x debt to equity

NYSE: ORCC │ 4 BENEFITS OF REDUCING THE ASSET COVERAGE REQUIREMENT Past performance is not a guarantee of future results. The adoption of the 150% asset coverage ratio will provide increased flexibility and the potential for incremental earnings while maintaining our conservative investment posture Increased Flexibility Reduces Risk for ORCC Maintains Conservative Investment Grade Profile Preserve Market Leadership and Competitive Positioning ▪ Our senior secured, first lien oriented portfolio supports modest incremental leverage ▪ Greater portfolio diversification ▪ We expect the modest incremental leverage should help increase ROE ▪ Increases cushion to regulatory leverage limit ▪ Intend to operate in a manner whereby ORCC maintains its investment grade credit profile ▪ All of our investment grade peers have already moved to reduce their asset coverage ratio; we are the last to do so ▪ Allows us to maintain our market leadership and competitive positioning versus our peers

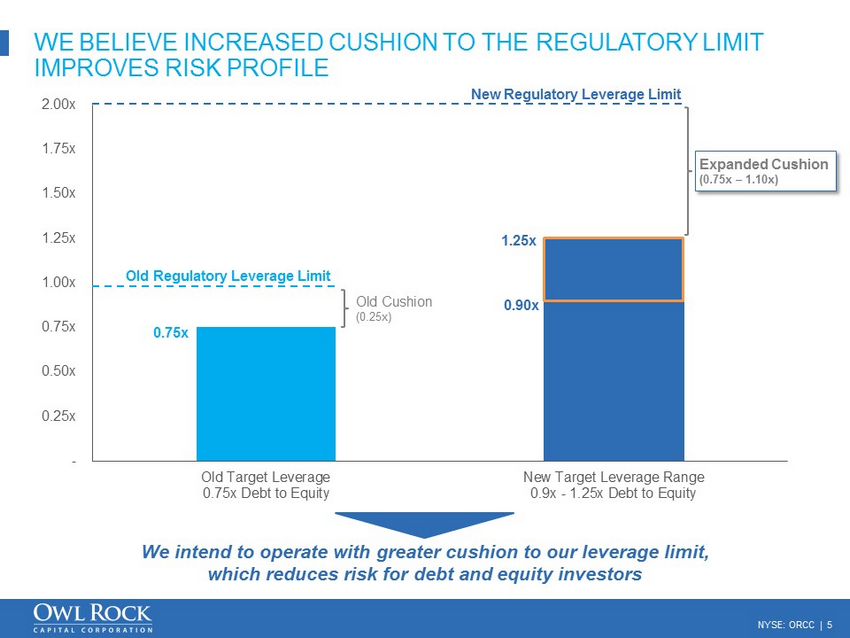

NYSE: ORCC │ 5 WE BELIEVE INCREASED CUSHION TO THE REGULATORY LIMIT IMPROVES RISK PROFILE 0.90x 0.75x 1.25x - 0.25x 0.50x 0.75x 1.00x 1.25x 1.50x 1.75x 2.00x Old Target Leverage 0.75x Debt to Equity New Target Leverage Range 0.9x - 1.25x Debt to Equity Old Regulatory Leverage Limit Old Cushion (0.25x) We intend to operate with greater cushion to our leverage limit, which reduces risk for debt and equity investors New Regulatory Leverage Limit Expanded Cushion (0.75x – 1.10x)

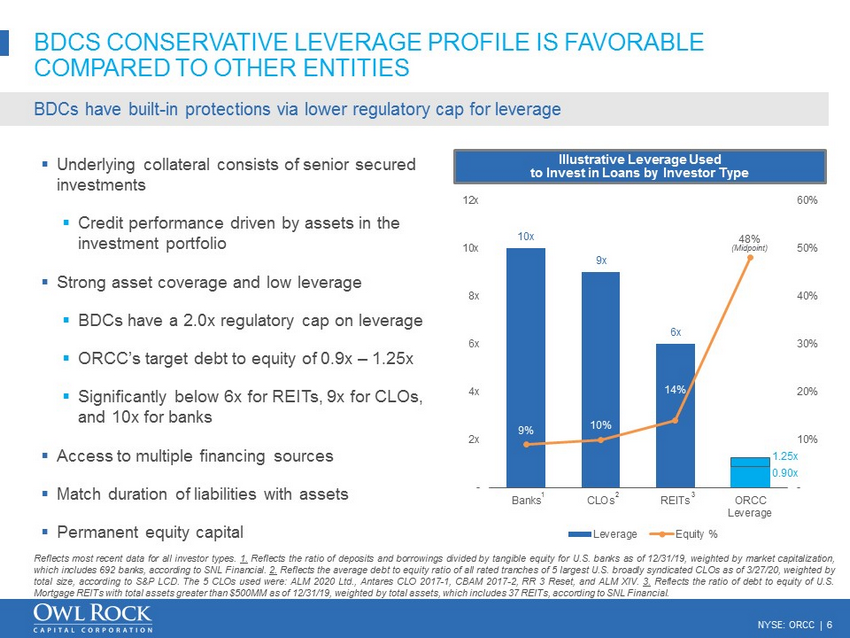

NYSE: ORCC │ 6 0.90x 10x 9x 6x 1.25x 9% 10% 14% 48% - 10% 20% 30% 40% 50% 60% - 2x 4x 6x 8x 10x 12x Banks CLOs REITs ORCC Leverage Leverage Equity % BDCS CONSERVATIVE LEVERAGE PROFILE IS FAVORABLE COMPARED TO OTHER ENTITIES ▪ Underlying collateral consists of senior secured investments ▪ Credit performance driven by assets in the investment portfolio ▪ Strong asset coverage and low leverage ▪ BDCs have a 2.0x regulatory cap on leverage ▪ ORCC’s target debt to equity of 0.9x – 1.25x ▪ Significantly below 6x for REITs, 9x for CLOs, and 10x for banks ▪ Access to multiple financing sources ▪ Match duration of liabilities with assets ▪ Permanent equity capital Illustrative Leverage Used to Invest in Loans by Investor Type BDCs have built - in protections via lower regulatory cap for leverage Reflects most recent data for all investor types . 1 . Reflects the ratio of deposits and borrowings divided by tangible equity for U . S . banks as of 12 / 31 / 19 , weighted by market capitalization, which includes 692 banks, according to SNL Financial . 2 . Reflects the average debt to equity ratio of all rated tranches of 5 largest U . S . broadly syndicated CLOs as of 3 / 27 / 20 , weighted by total size, according to S&P LCD . The 5 CLOs used were : ALM 2020 Ltd . , Antares CLO 2017 - 1 , CBAM 2017 - 2 , RR 3 Reset, and ALM XIV . 3 . Reflects the ratio of debt to equity of U . S . Mortgage REITs with total assets greater than $ 500 MM as of 12 / 31 / 19 , weighted by total assets, which includes 37 REITs, according to SNL Financial . 1 2 3 (Midpoint)

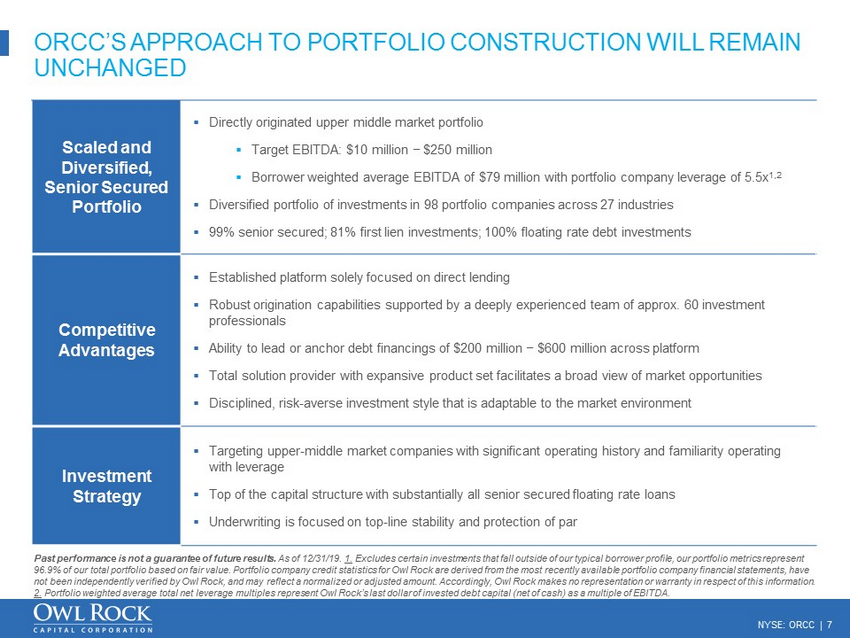

NYSE: ORCC │ 7 ORCC’S APPROACH TO PORTFOLIO CONSTRUCTION WILL REMAIN UNCHANGED Past performance is not a guarantee of future results. As of 12/31/19. 1. Excludes certain investments that fall outside of our typical borrower profile, our portfolio metrics represent 96.9% of our total portfolio based on fair value. Portfolio company credit statistics for Owl Rock are derived from the most rec ently available portfolio company financial statements, have not been independently verified by Owl Rock, and may reflect a normalized or adjusted amount. Accordingly, Owl Rock makes no rep resentation or warranty in respect of this information. 2. Portfolio weighted average total net leverage multiples represent Owl Rock’s last dollar of invested debt capital (net of cas h) as a multiple of EBITDA. Scaled and Diversified, Senior Secured Portfolio ▪ Directly originated upper middle market portfolio ▪ Target EBITDA: $10 million − $250 million ▪ Borrower weighted average EBITDA of $79 million with portfolio company leverage of 5.5x 1,2 ▪ Diversified portfolio of investments in 98 portfolio companies across 27 industries ▪ 99% senior secured; 81% first lien investments; 100% floating rate debt investments Competitive Advantages ▪ Established platform solely focused on direct lending ▪ Robust origination capabilities supported by a deeply experienced team of approx. 60 investment professionals ▪ Ability to lead or anchor debt financings of $200 million − $600 million across platform ▪ Total solution provider with expansive product set facilitates a broad view of market opportunities ▪ Disciplined, risk - averse investment style that is adaptable to the market environment Investment Strategy ▪ Targeting upper - middle market companies with significant operating history and familiarity operating with leverage ▪ Top of the capital structure with substantially all senior secured floating rate loans ▪ Underwriting is focused on top - line stability and protection of par

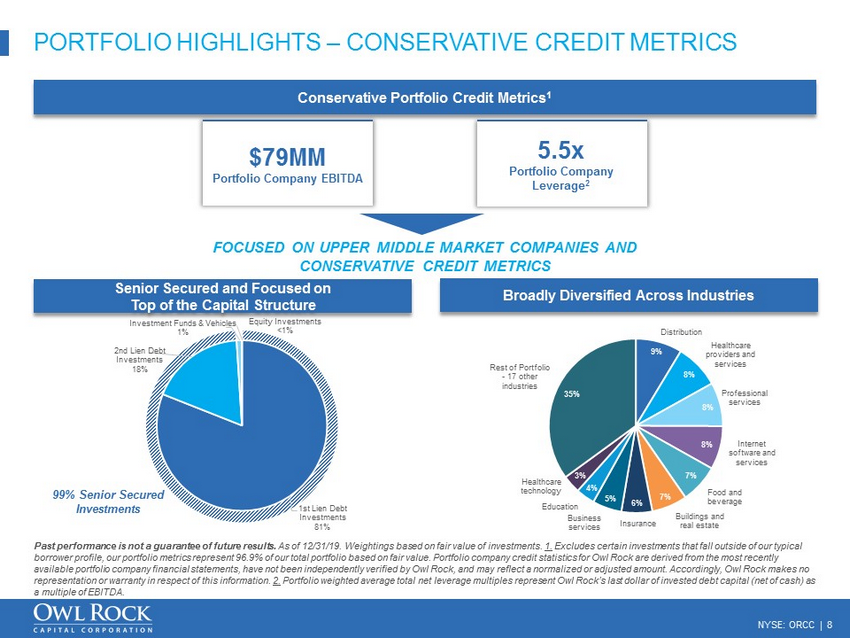

NYSE: ORCC │ 8 PORTFOLIO HIGHLIGHTS – CONSERVATIVE CREDIT METRICS $79MM Portfolio Company EBITDA 5.5x Portfolio Company Leverage 2 FOCUSED ON UPPER MIDDLE MARKET COMPANIES AND CONSERVATIVE CREDIT METRICS Senior Secured and Focused on Top of the Capital Structure Broadly Diversified Across Industries Conservative Portfolio Credit Metrics 1 Past performance is not a guarantee of future results. As of 12/31/19. Weightings based on fair value of investments. 1. Excludes certain investments that fall outside of our typical borrower profile, our portfolio metrics represent 96.9% of our total portfolio based on fair value . Portfolio company credit statistics for Owl Rock are derived from the most recently available portfolio company financial statements, have not been independently verified by Owl Rock, and may reflect a normali zed or adjusted amount. Accordingly, Owl Rock makes no representation or warranty in respect of this information. 2. Portfolio weighted average total net leverage multiples represent Owl Rock’s last dollar of invested debt capital (net of cash) as a multiple of EBITDA. 99% Senior Secured Investments 1st Lien Debt Investments 81% 2nd Lien Debt Investments 18% Investment Funds & Vehicles 1% Equity Investments <1% Distribution Healthcare providers and services Professional services Internet software and services Food and beverage Buildings and real estate Insurance Business services Education Healthcare technology Rest of Portfolio - 17 other industries 9% 8% 8% 8% 7% 7% 6% 5% 4% 3% 35%

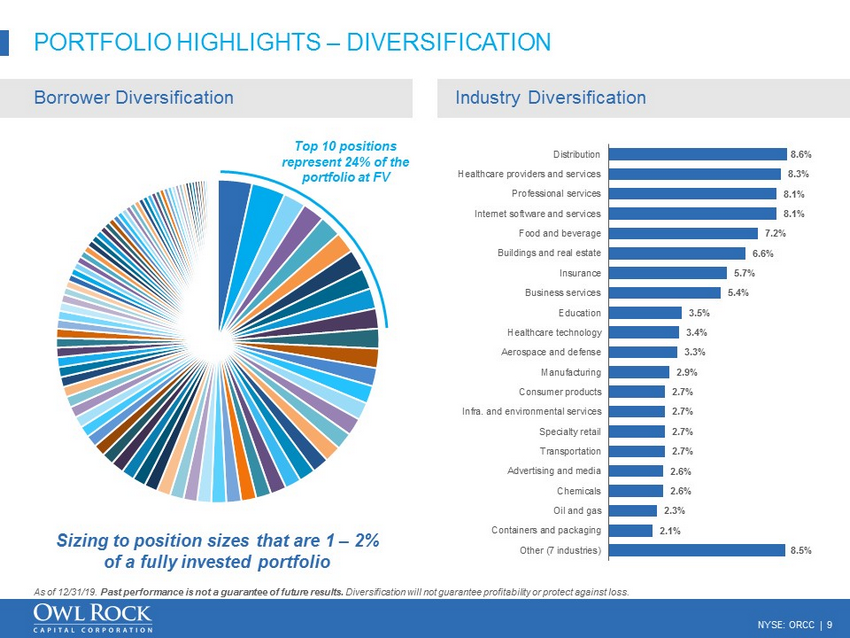

NYSE: ORCC │ 9 PORTFOLIO HIGHLIGHTS – DIVERSIFICATION Borrower Diversification Industry Diversification As of 12/31/19. Past performance is not a guarantee of future results. Diversification will not guarantee profitability or protect against loss. Sizing to position sizes that are 1 – 2% of a fully invested portfolio Top 10 positions represent 24% of the portfolio at FV 8.6% 8.3% 8.1% 8.1% 7.2% 6.6% 5.7% 5.4% 3.5% 3.4% 3.3% 2.9% 2.7% 2.7% 2.7% 2.7% 2.6% 2.6% 2.3% 2.1% 8.5% Distribution Healthcare providers and services Professional services Internet software and services Food and beverage Buildings and real estate Insurance Business services Education Healthcare technology Aerospace and defense Manufacturing Consumer products Infra. and environmental services Specialty retail Transportation Advertising and media Chemicals Oil and gas Containers and packaging Other (7 industries)

NYSE: ORCC │ 10 ORCC’S STRONG LIQUIDITY AND FUNDING PROFILE As of 3/26/20 unless otherwise noted. 1. The amount available does not reflect limitations related to each credit facility’s borrowing base. Reflects the use of the J ul y 2025 Notes proceeds and CLO III proceeds to pay down a portion of the Secured Revolver. ▪ ORCC is very well capitalized with attractive financing structures, which are well matched to our assets from a duration perspective and diversified across financing facilities and lenders ▪ Our financings have enabled a robust liquidity position that includes $2.0 billion 1 of cash and undrawn debt capacity ▪ We have approximately $0.5 billion in undrawn commitments to our portfolio companies, of which $0.2 billion are revolving credit facilities ▪ This means we have enough liquidity to fund all of our undrawn commitments over 3.5x ▪ Our strong liquidity position will also allow us to continue to support our existing borrowers and selectively deploy capital in additional investment opportunities ▪ ORCC has four investment grade ratings ▪ This has helped us issue approximately $1.5 billion of unsecured bonds across four issuances ▪ This means that over 40% of our funded debt capital is in unsecured debt, which provides us with significant unencumbered assets and meaningful overcollateralization of our secured credit facilities ▪ As of December 31, 2019, ORCC leverage was 0.46x, at the low end of industry peers ▪ Our weighted average debt maturity is over 5.5 years and we do not have any debt maturities until December 2022 ORCC has a strong liquidity position with attractive and diverse financing structures

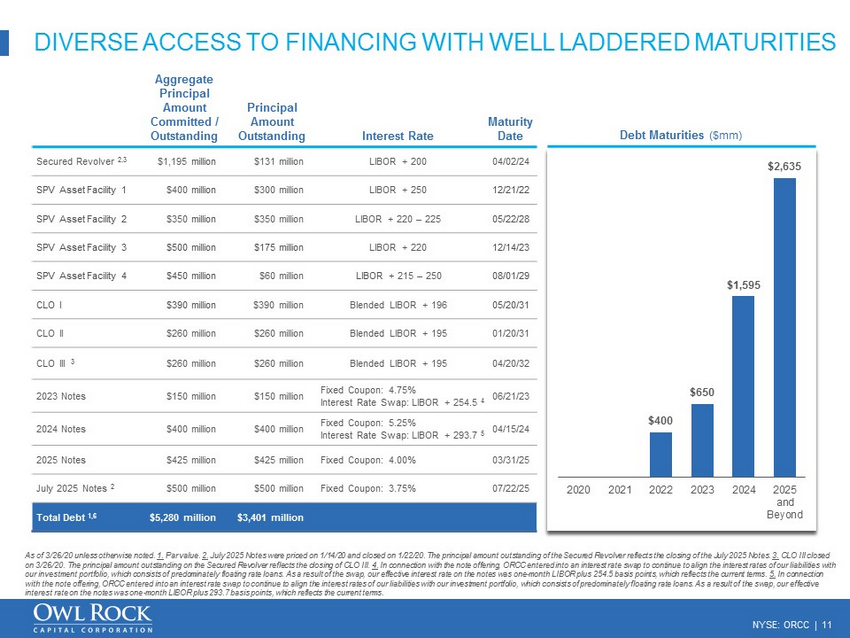

NYSE: ORCC │ 11 DIVERSE ACCESS TO FINANCING WITH WELL LADDERED MATURITIES Aggregate Principal Amount Committed / Outstanding Principal Amount Outstanding Interest Rate Maturity Date Secured Revolver 2,3 $1,195 million $131 million LIBOR + 200 04/02/24 SPV Asset Facility 1 $400 million $300 million LIBOR + 250 12/21/22 SPV Asset Facility 2 $350 million $350 million LIBOR + 220 – 225 05/22/28 SPV Asset Facility 3 $500 million $175 million LIBOR + 220 12/14/23 SPV Asset Facility 4 $450 million $60 million LIBOR + 215 – 250 08/01/29 CLO I $390 million $390 million Blended LIBOR + 196 05/20/31 CLO II $260 million $260 million Blended LIBOR + 195 01/20/31 CLO III 3 $260 million $260 million Blended LIBOR + 195 04/20/32 2023 Notes $150 million $150 million Fixed Coupon: 4.75% Interest Rate Swap: LIBOR + 254.5 4 06/21/23 2024 Notes $400 million $400 million Fixed Coupon: 5.25% Interest Rate Swap: LIBOR + 293.7 5 04/15/24 2025 Notes $425 million $425 million Fixed Coupon: 4.00% 03/31/25 July 2025 Notes 2 $500 million $500 million Fixed Coupon: 3.75% 07/22/25 Total Debt 1,6 $5,280 million $3,401 million Debt Maturities ($mm) As of 3/26/20 unless otherwise noted. 1. Par value. 2. July 2025 Notes were priced on 1/14/20 and closed on 1/22/20. The principal amount outstanding of the Secured Revolver reflec ts the closing of the July 2025 Notes. 3. CLO III closed on 3/26/20. The principal amount outstanding on the Secured Revolver reflects the closing of CLO III. 4. In connection with the note offering, ORCC entered into an interest rate swap to continue to align the interest rates of our li abilities with our investment portfolio, which consists of predominately floating rate loans. As a result of the swap, our effective interes t r ate on the notes was one - month LIBOR plus 254.5 basis points, which reflects the current terms. 5. In connection with the note offering, ORCC entered into an interest rate swap to continue to align the interest rates of our liabilities wi th our investment portfolio, which consists of predominately floating rate loans. As a result of the swap, our effective interest rate on the notes was one - month LIBOR plus 293.7 basis points, which reflects the current terms. $400 $650 $1,595 $2,635 2020 2021 2022 2023 2024 2025 and Beyond

NYSE: ORCC │ 12 WHAT DIFFERENTIATES OWL ROCK » Diversified portfolio designed for our large, institutional investor base – focused on quality and consistency » The right pool of capital to be the partner of choice for borrowers – offers flexibility & ability to commit and hold large investments » Large team of experienced, high - quality investment professionals, solely focused on direct lending – not part of a broad alternatives platform » Disciplined, risk - averse investment style » Purpose built to be a leading high - quality institutional BDC » Well protected and conservative dividend » Significant liquidity and access to capital

NYSE: ORCC │ 13 ANY QUESTIONS PLEASE CONTACT: ORCC Investor Relations ORCCIR@owlrock.com (212) 651 - 4705 www.OwlRockCapitalCorporation.com

NYSE: ORCC │ 14 IMPORTANT INFORMATION Important Information For Stockholders In connection with the proposal to reduce the Company’s minimum asset coverage ratio to 150%, the Company intends to file a p rel iminary proxy statement and an accompanying proxy card with the SEC. The information contained in the preliminary proxy statement will not be complete and m ay be changed. The Company will also file with the SEC a definitive version of the proxy statement and accompanying proxy card that will be sent or provided to st ock holders when available. The Company advises its stockholders and other interested persons to read the proxy statement and other proxy materials as they become av ail able because they will contain important information. The proxy materials will become available at no charge on the SEC’s website at http://www.sec.gov and on the Company’s website at http://www.owlrockcapitalcorporation.com. In addition, the Company will provide copies of the proxy statement without charge upo n request. This presentation contains proprietary information regarding Owl Rock, its affiliates and investment program, funds sponsored by Owl Rock (collectively the “Owl Rock Funds”) as well as investments held by the Owl Rocks Funds . This presentation and the information contained in this presentation may not be reproduced or distributed to others, in whole or in part, for any other purpose without the prior written consent of the Company . The views expressed and, except as otherwise indicated, the information provided are as of the report date and are subject to change, update, revision, verification and amendment, materially or otherwise, without notice, as market or other conditions change . Since these conditions can change frequently, there can be no assurance that the trends described herein will continue or that any forecasts are accurate . In addition, certain of the statements contained in this presentation may be statements of future expectations and other forward - looking statements that are based on the current views and assumptions of Owl Rock and involve known and unknown risks and uncertainties (including those discussed below) that could cause actual results, performance or events to differ materially from those expressed or implied in such statements . These statements may be forward - looking by reason of context or identified by words such as “may, will, should, expects, plans, intends, anticipates, believes, estimates, predicts, potential or continue” and other similar expressions . Neither Owl Rock, its affiliates, nor any of Owl Rock’s or its affiliates' respective advisers, members, directors, officers, partners, agents, representatives or employees or any other person (collectively the “Owl Rock Entities”) is under any obligation to update or keep current the information contained in this document . This presentation contains information from third party sources which Owl Rock has not verified . No representation or warranty, express or implied, is given by or on behalf of the Owl Rock Entities as to the accuracy, fairness, correctness or completeness of the information or opinions contained in this presentation and no liability whatsoever (in negligence or otherwise) is accepted by the Owl Rock Entities for any loss howsoever arising, directly or indirectly, from any use of this presentation or its contents, or otherwise arising in connection therewith . Performance Information : Where performance returns have been included in this presentation, Owl Rock has included herein important information relating to the calculation of these returns as well as other pertinent performance related definitions . All investments are subject to risk, including the loss of the principal amount invested . These risks may include limited operating history, uncertain distributions, inconsistent valuation of the portfolio, changing interest rates, leveraging of assets, reliance on the investment advisor, potential conflicts of interest, payment of substantial fees to the investment advisor and the dealer manager, potential illiquidity and liquidation at more or less than the original amount invested . Diversification will not guarantee profitability or protection against loss . Performance may be volatile and the NAV may fluctuate . This presentation does not constitute a prospectus and should under no circumstances be understood as an offer to sell or the solicitation of an offer to buy our common stock or any other securities nor will there be any sale of the common stock or any other securities referred to in this presentation in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction . Nothing in these materials should be construed as a recommendation to invest in any securities that may be issued by ORCC or as legal, accounting or tax advice . Copyright© Owl Rock Capital Partners LP 2020 . All rights reserved . This presentation is proprietary and may not to be reproduced, transferred or distributed in any form without prior written permission from Owl Rock . It is delivered on an “as is” basis without warranty or liability . All individual charts, graphs and other elements contained within the information are also copyrighted works and may be owned by a party other than Owl Rock . By accepting the information, you agree to abide by all applicable copyright and other laws, as well as any additional copyright notices or restrictions contained in the information .