UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

| OWL ROCK CAPITAL CORPORATION | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

399

Park Avenue, 38th Floor

New York, New York 10022

April 17, 2020

Dear Shareholder:

You are cordially invited to attend the annual meeting of shareholders of Owl Rock Capital Corporation (the "Company") to be held on June 8, 2020 at 8:30 a.m., Eastern Time, at the offices of the Company, 399 Park Avenue, 38th Floor, New York, New York 10022 (the "Annual Meeting").

Your vote is very important! Your immediate response will help avoid potential delays and may save the Company significant additional expenses associated with soliciting shareholder votes.

The Notice of the Annual Meeting and proxy statement accompanying this letter provide an outline of the business to be conducted at the meeting. The Annual Meeting is being held for the following purposes:

(i) to elect two members of the board of directors of the Company (the "Board") to serve until the 2023 annual meeting of shareholders and until their successors are duly elected and qualified;

(ii) to ratify the appointment of KPMG LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2020;

(iii) to approve a proposal to allow the Company to increase its leverage by approving the application to the Company of a minimum asset coverage ratio of 150%, pursuant to Section 61(a)(2) of the Investment Company Act of 1940, as amended, to become effective the date after the Annual Meeting, which would permit the Company to double the maximum amount of leverage that it is currently permitted to incur; and

(iv) to transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof.

The Company's Board unanimously recommends that you vote FOR each of the proposals to be considered and voted on at the Annual Meeting.

The Company has elected to provide access to its proxy materials to certain of its shareholders over the internet under the U.S. Securities and Exchange Commission's "notice and access" rules. On or about April 20, 2020, the Company intends to mail to most of its shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access the proxy statement and annual report on Form 10-K for the year ended December 31, 2019 (the "Annual Report"), and how to submit proxies over the internet. All other shareholders will receive a copy of the proxy statement and Annual Report by mail. The Notice of Internet Availability of Proxy Materials also contains instructions on how you can elect to receive a printed copy of the proxy statement and Annual Report. The Company believes that providing its proxy materials over the internet will expedite shareholders' receipt of proxy materials, lower the costs associated with the Annual Meeting and conserve resources.

It is important that your shares of the Company's common stock, par value $0.01 per share, be represented at the Annual Meeting. If you are unable to attend the meeting in person, I urge you to complete, date and sign the enclosed proxy card and promptly return it in the envelope provided, or follow the instructions printed on the Notice of Internet Availability of Proxy Materials or the proxy card to authorize a proxy through the internet.

Your vote and participation in the governance of the Company are very important.

Sincerely yours,

Craig

W. Packer

Chief Executive Officer, President and Director

OWL ROCK CAPITAL CORPORATION

399 Park Avenue, 38th Floor

New York, New York 10022

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On June 8, 2020

To the Shareholders of Owl Rock Capital Corporation:

NOTICE IS HEREBY GIVEN THAT the annual meeting of shareholders of Owl Rock Capital Corporation, a Maryland corporation (the "Company"), will be held at the offices of the Company, 399 Park Avenue, 38th Floor, New York, New York 10022, on June 8, 2020 at 8:30 a.m., Eastern Time (the "Annual Meeting"), for the following purposes:

The Board has fixed the close of business on April 13, 2020 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting and adjournments or postponements thereof.

Important notice regarding the availability of proxy materials for the Annual Meeting. The Company's proxy statement, the proxy card, and the Company's annual report on Form 10-K for the fiscal year ended December 31, 2019 (the "Annual Report") are available at www.proxyvote.com.

If you plan to attend the Annual Meeting and vote your shares of the Company's common stock in person, you will need to bring photo identification in order to be admitted to the Annual Meeting. In addition, please be advised that the Company is monitoring the recent global outbreak of COVID-19 (more commonly known as the Coronavirus) and the related health and travel concerns. If the Company determines that it is not advisable to hold the Annual Meeting in person, the Company may determine to hold a virtual meeting of shareholders, which will be conducted via live webcast. If such a determination is made, the Company will, as promptly as possible, announce details on how to participate in such virtual Annual Meeting by issuing a press release and posting such information at www.proxyvote.com. In addition, such details will be filed with the U.S. Securities and Exchange Commission ("SEC") as additional proxy materials.

| By Order of the Board of Directors, | ||

Neena Reddy Secretary |

April 17, 2020

Shareholders are requested to promptly authorize a proxy vote over the internet, or execute and return promptly the accompanying proxy card, which is being solicited by the Board. You may authorize a proxy over the internet by following the instructions in the Notice of Internet Availability of Proxy Materials or the proxy card. You may execute the proxy card using the methods described in the proxy card. Executing the proxy card is important to ensure a quorum at the Annual Meeting. Proxies may be revoked at any time before they are exercised by submitting a written notice of revocation or a subsequently executed proxy, or by attending the Annual Meeting and voting in person.

OWL ROCK CAPITAL CORPORATION

399 Park Avenue, 38th Floor

New York, New York 10022

ANNUAL MEETING OF SHAREHOLDERS

To Be Held On June 8, 2020

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

What is the date of the Annual Meeting and where will it be held?

The annual meeting (the "Annual Meeting") of shareholders of Owl Rock Capital Corporation, which is sometimes referred to in this proxy statement as "we", "us", "our", or the "Company," will be held on June 8, 2020 at the principal offices of the Company, 399 Park Avenue, 38th Floor, New York, New York, 10022 at 8:30 a.m. Eastern Time.

What will I be voting on at the Annual Meeting?

At the Annual Meeting, shareholders will be asked to:

Who can vote at the Annual Meeting?

Only shareholders of record as of the close of business on April 13, 2020 (the "Record Date") are entitled to notice of, and to vote at, the Annual Meeting and any postponements or adjournments thereof.

How many votes do I have?

Holders of the Company's common stock are entitled to one vote for each share held as of the Record Date.

How may I vote?

In Person. You may vote in person at the Annual Meeting by requesting a ballot when you arrive. You must bring valid picture identification, such as a driver's license or passport, and may be requested to provide proof of stock ownership as of the Record Date.

By Proxy through the Internet. You may authorize a proxy through the internet using the web address included in your Notice of Internet Availability of Proxy Materials. Authorizing a proxy through the internet requires you to input the control number located on your Notice of Internet Availability of Proxy Materials. After inputting the control number, you will be prompted to direct your proxy to vote on each proposal. You will have an opportunity to review your directions and make any necessary changes before submitting your directions and terminating the internet link.

1

By Proxy through the Mail. When voting by proxy and mailing your proxy card, you are required to:

Does the Board recommend voting for each of the Proposals?

Yes. The Board unanimously recommends that you vote "FOR" each of the proposals.

2

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

The accompanying proxy is solicited on behalf of the Board for use at the Annual Meeting to be held at the offices of the Company, 399 Park Avenue, 38th Floor, New York, New York 10022, on June 8, 2020 at 8:30 a.m., Eastern Time. Only holders of record of our common stock at the close of business on April 13, 2020, which is the Record Date, will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, we had 388,437,705 shares of common stock, par value $0.01 per share (the "Shares"), outstanding and entitled to vote. This proxy statement, including the accompanying form of proxy (collectively, the "Proxy Statement"), or a Notice of Internet Availability of Proxy Materials containing instructions on how to access the Proxy Statement and annual report on Form 10-K for the fiscal year ended December 31, 2019 (the "Annual Report"), and how to submit proxies over the internet are first being sent to shareholders on or about April 20, 2020. The Annual Report and Proxy Statement can both be accessed online at www.proxyvote.com.

All proxies will be voted in accordance with the instructions contained therein. Unless contrary instructions are specified, if a proxy is properly executed and received by the Company (and not revoked) prior to the Annual Meeting, the Shares represented by the proxy will be voted (1) FOR the election of two members of the Board to serve until the 2023 annual meeting of shareholders and until their successors are duly elected and qualified, (2) FOR the ratification of the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020, and (3) FOR the proposal to allow the Company to reduce its asset coverage ratio to 150%, pursuant to Section 61(a)(2) of the Investment Company Act of 1940, as amended, to become effective the date after the Annual Meeting. Should any matter not described above be properly presented at the Annual Meeting, the named proxies will vote in accordance with their best judgment as permitted.

Voting Rights

Holders of our common stock are entitled to one vote for each share held as of the Record Date.

The Annual Meeting is being held for the following purposes:

1. To elect two members of the Board to serve until the 2023 annual meeting of shareholders and until their successors are duly elected and qualified;

2. To ratify the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020;

3. To approve a proposal to allow the Company to reduce its asset coverage ratio to 150%, pursuant to Section 61(a)(2) of the Investment Company Act of 1940, as amended, to become effective the date after the Annual Meeting; and

4. To transact such other business as may properly come before the Annual Meeting, or any postponement or adjournment thereof.

Quorum Required

A majority of the outstanding Shares must be present or represented by proxy at the Annual Meeting in order to have a quorum. If you have properly voted by proxy via internet or mail, you will be considered part of the quorum. We will count "abstain" votes as present for the purpose of establishing a quorum for the transaction of business at the Annual Meeting. If at any time Shares are held through brokers, we will count broker non-votes as present for the purpose of establishing a quorum. A broker non-vote occurs when a broker holding Shares for a beneficial owner votes on some matters on the proxy card, but not on others, because the broker does not have instructions from the beneficial owner or discretionary authority (or declines to exercise discretionary authority) with respect to those other matters.

3

Vote Required

Proposal

|

Vote Required | Broker Discretionary Voting Allowed | Effect of Abstentions and Broker Non-Votes | |||

|---|---|---|---|---|---|---|

Proposal 1—To elect two members of the Board to serve until the 2023 annual meeting of shareholders and until their successors are duly elected and qualified |

Affirmative vote of a majority of the votes cast at the Annual Meeting in person or by proxy. | No | Abstentions and broker non-votes will have no effect on the result of the vote. | |||

Proposal 2—To ratify the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020 |

Affirmative vote of a majority of the votes cast at the Annual Meeting in person or by proxy. | Yes | Abstentions and broker non-votes will have no effect on the result of the vote. | |||

Proposal 3—To approve a proposal to allow the Company to reduce its asset coverage ratio to 150%, pursuant to Section 61(a)(2) of the Investment Company Act of 1940, as amended, to become effective the date after the Annual Meeting |

Affirmative vote of a majority of the votes cast at the Annual Meeting in person or by proxy. | No | Abstentions and broker non-votes will have no effect on the result of the vote. | |||

Proposal 4—To transact such other business as may properly come before the Annual Meeting, or any postponement or adjournment thereof |

Affirmative vote of a majority of the votes cast at the Annual Meeting in person or by proxy. | No | Abstentions and broker non-votes will have no effect on the result of the vote. |

You may vote "for" or "against," or abstain from voting on Proposal 1, Proposal 2, Proposal 3 and Proposal 4. The adoption of each of Proposal 1, Proposal 2, Proposal 3 and Proposal 4 requires the affirmative vote of the majority of votes cast for each such proposal at the Annual Meeting, meaning the number of shares voted "for" each proposal must exceed the number of shares voted "against" such proposal. The inspector of elections appointed for the Annual Meeting will separately tabulate "for" votes, "against" votes, "abstain" votes, and broker non-votes.

Voting

You may vote in person at the Annual Meeting or by proxy in accordance with the instructions provided below. You also may authorize a proxy through the internet using the web address included in your Notice of Internet Availability of Proxy Materials. Authorizing a proxy through the internet requires you to input the control number located on your Notice of Internet Availability of Proxy Materials. After inputting the control number, you will be prompted to direct your proxy to vote on each proposal. You will have an opportunity to review your directions and make any necessary changes before submitting your directions and terminating the internet link. When voting by proxy and mailing your proxy card, you are required to:

4

Important notice regarding the availability of proxy materials for the Annual Meeting. The Company's Proxy Statement, the proxy card, and the Company's Annual Report are available at www.proxyvote.com. The Notice of Internet Availability of Proxy Materials contains instructions on how you can elect to receive a printed copy of the Proxy Statement and Annual Report.

If you plan to attend the Annual Meeting and vote your shares of the Company's common stock in person, you will need to bring photo identification in order to be admitted to the Annual Meeting.

Quorum and Adjournment

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the shares of our common stock outstanding on the Record Date will constitute a quorum.

If a quorum is not present at the Annual Meeting, the Chairman may adjourn the Annual Meeting until a quorum is present.

Proxies for the Annual Meeting

The named proxies for the Annual Meeting are Neena Reddy and Alan Kirshenbaum (or their duly authorized designees), who will follow submitted proxy voting instructions. They will vote as the Board recommends herein as to any submitted proxies that do not direct how to vote on any item, and will vote on any other matters properly presented at the Annual Meeting in their judgment.

Expenses of Soliciting Proxies

The Company will pay the expenses of soliciting proxies to be voted at the Annual Meeting, including the cost of preparing and posting this Proxy Statement and the Annual Report to the internet, and the cost of mailing the Notice of Annual Meeting, the Notice of Internet Availability of Proxy Materials, and any requested proxy materials to the shareholders. The Company has engaged Broadridge Financial Solutions, Inc. ("Broadridge"), an independent proxy solicitation firm, to assist in the distribution of the proxy materials and tabulation of proxies. The cost of Broadridge's services with respect to the Company is estimated to be approximately $40,000 plus reasonable out-of-pocket expenses.

Revocability of Proxies

A shareholder may revoke any proxy that is not irrevocable by attending the Annual Meeting and voting in person or by delivering a proxy in accordance with applicable law bearing a later date to the Secretary of the Company.

Contact Information for Proxy Solicitation

You can contact us by mail sent to the attention of the Secretary of the Company, Neena Reddy, at our principal executive offices located at 399 Park Avenue, 38th Floor, New York, New York 10022. You can call us by dialing (212) 419-3000. You can access our proxy materials online at www.proxyvote.com.

Record Date

The Board has fixed the close of business on April 13, 2020 as the Record Date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting and adjournments or postponements thereof. As of the Record Date, there were 388,437,705 Shares outstanding.

5

Notice of Internet Availability of Proxy Materials

In accordance with regulations promulgated by the SEC, the Company has made this Proxy Statement, the Notice of Annual Meeting of Shareholders, and the Annual Report available to shareholders on the internet. Shareholders may (i) access and review the Company's proxy materials, (ii) authorize their proxies, as described in "Voting," and/or (iii) elect to receive future proxy materials by electronic delivery, via the internet address provided below.

This Proxy Statement, the Notice of Annual Meeting and the Annual Report are available at www.proxyvote.com.

Electronic Delivery of Proxy Materials

Pursuant to the rules adopted by the SEC, the Company furnishes proxy materials by email to those shareholders who have elected to receive their proxy materials electronically. While the Company encourages shareholders to take advantage of electronic delivery of proxy materials, which helps to reduce the environmental impact of annual meetings and the cost associated with the physical printing and mailing of materials, shareholders who have elected to receive proxy materials electronically by email, as well as beneficial owners of shares of the Company's common stock held by a broker or custodian, may request a printed set of proxy materials. The Notice of Internet Availability of Proxy Materials contains instructions on how you can elect to receive a printed copy of the Proxy Statement and Annual Report.

6

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

Beneficial ownership is determined in accordance with the rules and regulations of the SEC. These rules generally provide that a person is the beneficial owner of securities if such person has or shares the power to vote or direct the voting thereof, or to dispose or direct the disposition thereof or has the right to acquire such powers within 60 days. The following table sets forth, as of March 31, 2020 the beneficial ownership according to information furnished to us by such persons or publicly available filings. Ownership information for those persons who beneficially own 5% or more of the outstanding shares of our common stock is based upon filings by such persons with the SEC and other information obtained from such persons of each current director, the nominees for director, the Company's executive officers, the executive officers and directors as a group, and each person known to us to beneficially own 5% or more of the outstanding shares of our common stock.

The percentage ownership is based on 388,437,705 shares of our common stock outstanding as of April 13, 2020. To our knowledge, except as indicated in the footnotes to the table, each of the shareholders listed below has sole voting and/or investment power with respect to shares of our common stock beneficially owned by such shareholder.

Name and Address

|

Number of Shares Owned |

Percentage of Class Outstanding |

|||||

|---|---|---|---|---|---|---|---|

5% Owners |

| | |||||

The Regents of the University of California(1) |

43,960,361 | 11 | % | ||||

Interested Directors |

| | |||||

Douglas I. Ostrover(2) |

6,701,955 | 2 | % | ||||

Craig W. Packer(3) |

| 131,466 | | * | |||

Alan Kirshenbaum |

27,994 | * | |||||

Independent Directors |

| | |||||

Brian Finn(4) |

38,117 | * | |||||

Edward D'Alelio |

| — | | 0 | % | ||

Eric Kaye(5) |

15,395 | 0 | % | ||||

Christopher M. Temple |

| 12,874 | | * | |||

Executive Officers |

0 | % | |||||

Karen Hager |

| — | | 0 | % | ||

Bryan Cole |

— | 0 | % | ||||

Alexis Maged |

| — | | 0 | % | ||

Neena Reddy |

— | 0 | % | ||||

All officers and directors as a group (11 persons)(6) |

| 6,927,801 | | 2 | % | ||

7

PROPOSAL 1: ELECTION OF DIRECTOR NOMINEES

At the Annual Meeting, shareholders of the Company are being asked to consider the election of two directors of the Company. Pursuant to the Company's bylaws, the number of directors on the Board may not be fewer than the minimum number required by the Maryland General Corporation Law, or greater than eleven. Under the Company's Articles of Amendment and Restatement, (the "Charter"), the directors are divided into three classes. Each class of directors holds office for a three-year term. However, the initial members of the three classes have initial terms of one, two, and three years, respectively. The Board currently consists of seven directors who serve in the following classes: Class I (terms ending at the Annual Meeting)—Brian Finn and Eric Kaye; Class II (terms ending at the 2021 annual meeting of shareholders)—Douglas I. Ostrover and Christopher M. Temple; and Class III (terms ending at the 2022 annual meeting of shareholders)—Edward D'Alelio, Alan Kirshenbaum, and Craig W. Packer.

Brian Finn and Eric Kaye each has been nominated for election by the Board to serve a three-year term until the 2023 annual meeting of shareholders and until each of their successors are duly elected and qualified. Each director nominee has agreed to serve as a director if re-elected and has consented to being named as a nominee.

A shareholder can vote for, against or abstain from voting for any or all of the director nominees. In the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such proxy FOR the election of each of the director nominees named below. If any of the director nominees should decline or be unable to serve as a director, the persons named as proxies will vote for such other nominee as may be proposed by the Board's Nominating and Corporate Governance Committee. The Board has no reason to believe that any of the persons named as director nominees will be unable or unwilling to serve.

Required Vote

Each director nominee shall be elected by a majority of all the votes cast at the Annual Meeting in person or by proxy, provided that a quorum is present. Abstentions will not be included in determining the number of votes cast and, as a result, will not have any effect on the result of the vote with respect to the Director Proposal. There will be no cumulative voting with respect to Proposal 1.

Information about the Nominees and Directors

Set forth below is information, as of April 13, 2020, regarding Messrs. Finn and Kaye, who are being nominated for election as directors of the Company by the Company's shareholders at the Annual Meeting, as well as information about the Company's other current directors whose terms of office will continue after the Annual Meeting. Neither Mr. Finn nor Mr. Kaye is being proposed for election pursuant to any agreement or understanding between either Mr. Finn or Mr. Kaye, on the one hand, and the Company or any other person or entity, on the other hand.

The information below includes specific information about each director's experience, qualifications, attributes or skills that led the Board to the conclusion that the individual is qualified to serve on the Board, in light of the Company's business and structure. There were no legal proceedings of the type described in Items 401(f)(7) and (8) of Regulation S-K in the past 10 years against any of our directors, director nominees or officers, and none are currently pending.

8

Nominees for Class I Directors—Terms Expiring 2023:

Name, Address, and Age(1) |

Position(s) held with the Company |

Principal Occupation(s) During the Past 5 Years |

Term of Office and Length of Time Served(2) |

Number of Companies in Fund Complex(3) Overseen by Director |

Other Directorships Held by Director or Nominee for Director |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

| Independent Director Nominees | ||||||||||

| Brian Finn, 59 | Director |

Private Investor Chief Executive Officer, Asset Management Finance Corporation (through 2013) |

Class I Director since 2016; Term expires in 2020 | 3 |

Owl Rock Capital Corporation II ("ORCC II") Owl Rock Technology Finance Corp. ("ORTF") The Scotts Miracle Gro Company |

|||||

| Eric Kaye, 57 | Director | Founder of Kayezen, LLC (formerly ARQ^EX Fitness Systems) | Class I Director since 2016; Term expires in 2020 | 3 |

ORCC II ORTF |

|||||

Mr. Kaye is the founder of Kayezen, LLC (formerly ARQ^EX Fitness Systems), a physical therapy and fitness equipment design company. Prior to founding Kayezen, LLC, Mr. Kaye served as a Vice Chairman and Managing Director of UBS Investment Bank, and a member of the division's Global Operating and U.S. Executive Committees, from June 2001 to May 2012. For the majority of Mr. Kaye's tenure with UBS, he was a Managing Director and led the firm's Exclusive Sales and Divestitures Group, where he focused on advising middle market companies. Prior to joining UBS, Mr. Kaye served as Global Co-Head of Mergers & Acquisitions for Robertson Stephens, an investment banking firm, from February 1998 to June 2001. Mr. Kaye joined Robertson Stephens from PaineWebber where he served as Executive Director and head of the firm's Technology Mergers & Acquisitions team. Since 2016 he has served on the boards of the Company and ORCC II, since 2018 he has served on the board of ORTF and since 2020 he has served on the board of Owl Rock Capital Corporation III ("ORCC III"). Mr. Kaye holds a B.A. from Union College and an M.B.A. from Columbia Business School.

The Company believes Mr. Kaye's management positions and experiences in the middle market provide the Board with valuable insight.

Mr. Finn served as the Chief Executive Officer of Asset Management Finance Corporation from 2009 to March 2013 and as its Chairman from 2008 to March 2013. From 2004 to 2008, Mr. Finn was Chairman and Head of Alternative Investments at Credit Suisse Group. Mr. Finn held many positions within Credit Suisse and its predecessor firms, including President of Credit Suisse First Boston (CSFB), President of Investment Banking, Co President of Institutional Securities, Chief Executive Officer of Credit Suisse USA and was a member of the Office of the Chairman of CSFB. He also was a member of the Executive Board of Credit Suisse. Mr. Finn served as principal and partner of private equity firm Clayton, Dubilier & Rice from 1997 to 2002. Mr. Finn currently serves as Chairman of Covr Financial Technologies Corp., a director of The Scotts Miracle Gro Company, and WaveGuide Corporation, Chairman of Star Mountain Capital, a lower middle market credit investment firm, Investment Partner of Nyca Partners, a financial technology venture capital firm and a director of Sarcos Robotics. Since 2016 he has served on the boards of the Company and ORCC II, since 2018 he

9

has served on the board of ORTF and since 2020 he has served on the board of ORCC III. Mr. Finn received a B.S. in Economics from The Wharton School, University of Pennsylvania.

The Company believes Mr. Finn's numerous management positions and broad experiences in the financial services sector provide him with skills and valuable insight in handling complex financial transactions and issues, all of which make him well qualified to serve on the Board.

Incumbent Class II Directors—Term Expiring 2021

Name, Address, and Age(1) |

Position(s) held with the Company |

Principal Occupation(s) During the Past 5 Years |

Term of Office and Length of Time Served(2) |

Number of Companies in Fund Complex(3) Overseen by Director |

Other Directorships Held by Director or Nominee for Director |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

| Independent Director | ||||||||||

Christopher M. Temple, 52 |

Director |

President of DelTex Capital LLC |

Class II Director since 2016; Term expires in 2021 |

3 |

ORCC II ORTF Plains All American Pipeline Company |

|||||

| Interested Director(4) | ||||||||||

Douglas I. Ostrover, 57 |

Director |

Co-Founder and Chief Executive Officer of Owl Rock Capital Partners LP ("Owl Rock Capital Partners") |

Class II Director since 2016; Term expires in 2021 |

3 |

ORCC II ORTF |

|||||

|

Co-Chief Investment Officer of Owl Rock Capital Advisors LLC (the "Adviser"), Owl Rock Technology Advisors LLC ("ORTA"), and Owl Rock Capital Private Fund Advisors LLC ("ORPFA," and together with the Adviser, ORTA and Owl Rock Capital Partners, "Owl Rock") Co-Founder GSO Capital Partners |

|

|

|||||||

Mr. Temple has served as President of DelTex Capital LLC (a private investment firm) since its founding in 2010. Mr. Temple has served as an Operating Executive/Consultant for Tailwind Capital, LLC, a New York-based middle market private equity firm since June 2011. Prior to forming DelTex Capital, Mr. Temple served as President of Vulcan Capital, the investment arm of Vulcan Inc., from May 2009 until December 2009 and as Vice President of Vulcan Capital from September 2008 to May 2009. Prior to joining Vulcan in September 2008, Mr. Temple served as a managing director at Tailwind Capital, LLC from May to August 2008. Prior to joining Tailwind, Mr. Temple was a managing director at Friend Skoler & Co., Inc. from May 2005 to May 2008. From April 1996 to December 2004, Mr. Temple was a managing director at Thayer Capital Partners. Mr. Temple started his career in the audit and tax departments of KPMG's Houston office and was a licensed CPA from 1989 to 1993. Mr. Temple has served on the board of directors of Plains GP Holdings, L.P., the general partner of Plains All American Pipeline Company since November 2016 and as a director of Plains All American Pipeline, L.P's ("PAA") general partner from May 2009 to November 2016. He was a member of the

10

PAA Audit Committee from 2009 to 2016. Prior public board service includes board and audit committee service for Clear Channel Outdoor Holdings from April 2011 to May 2016 and on the board and audit committee of Charter Communications Inc. from November 2009 through January 2011. In addition to public boards, as part of his role with Tailwind, Mr. Temple has served on private boards including Brawler Industries, and National HME and currently serves on the boards of Loenbro, Inc. and HMT, LLC. Since 2016 he has served on the boards of the Company and ORCC II, since 2018 he has served on the board of ORTF and since 2020 he has served on the board of ORCC III. Mr. Temple holds a B.B.A., magna cum laude, from the University of Texas and an M.B.A. from Harvard.

The Company believes Mr. Temple's broad investment management background, together with his financial and accounting knowledge, brings important and valuable skills to the Board.

Mr. Ostrover is a Co-Founder of Owl Rock Capital Partners and also serves as Chief Executive Officer and Co-Chief Investment Officer of the Adviser, ORTA and ORPFA (collectively, the "Owl Rock Advisers"), and is a member of the Investment Committee of each of the Company, ORCC II and ORTF (the "Owl Rock BDCs"). In addition, Mr. Ostrover has served on the boards of the Company and ORCC II since 2016, on the board of ORTF since 2018 and on the board of ORCC III since 2020. Prior to co-founding Owl Rock, Mr. Ostrover was one of the founders of GSO Capital Partners (GSO), Blackstone's alternative credit platform, and a Senior Managing Director at Blackstone until 2015. Prior to co-founding GSO in 2005, Mr. Ostrover was a Managing Director and Chairman of the Leveraged Finance Group of Credit Suisse First Boston (CSFB). Prior to his role as Chairman, Mr. Ostrover was Global Co-Head of CSFB's Leveraged Finance Group, during which time he was responsible for all of CSFB's origination, distribution and trading activities relating to high yield securities, leveraged loans, high yield credit derivatives and distressed securities. Mr. Ostrover was a member of CSFB's Management Council and the Fixed Income Operating Committee. Mr. Ostrover joined CSFB in November 2000 when CSFB acquired Donaldson, Lufkin & Jenrette ("DLJ"), where he was a Managing Director in charge of High Yield and Distressed Sales, Trading and Research. Mr. Ostrover had been a member of DLJ's high yield team since he joined the firm in 1992. Mr. Ostrover is actively involved in non-profit organizations including serving on the board of directors of the Michael J. Fox Foundation. Mr. Ostrover is also a board member of the Brunswick School. Mr. Ostrover received a B.A. in Economics from the University of Pennsylvania and an M.B.A. from New York University Stern School of Business.

The Company believes Mr. Ostrover's depth of experience in corporate finance, capital markets and financial services, gives the Board valuable industry-specific knowledge and expertise on these and other matters, and his history with the Company and the Adviser, provide an important skillset and knowledge base to the Board.

11

Incumbent Class III Directors—Terms Expiring 2022:

Name, Address, and Age(1) |

Position(s) held with the Company |

Principal Occupation(s) During the Past 5 Years |

Term of Office and Length of Time Served(2) |

Number of Companies in Fund Complex(3) Overseen by Director |

Other Directorships Held by Director or Nominee for Director |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

| Independent Director | ||||||||||

| Edward D'Alelio, 67 | Chairman of the Board; Director | Retired | Class III Director since 2016; Term expires in 2022 | 3 |

ORCC II ORTF Blackstone/GSO Long Short Credit Fund Blackstone/GSO Sen. Flt Rate Fund |

|||||

| Interested Directors(4) | ||||||||||

| Craig W. Packer, 53 | Chief Executive Officer; President; Director |

Co-Founder of Owl Rock Capital Partners Co-Chief Investment Officer of the Adviser, ORTA, and ORPFA President and Chief Executive Officer of the Company, ORCC II and ORTF Co-Head of Leveraged Finance in the Americas, Goldman Sachs |

Class III Director since 2016; Term expires in 2022 | 3 |

ORCC II ORTF |

|||||

Alan Kirshenbaum, 48 |

Chief Operating Officer; Chief Financial Officer; Director |

Chief Operating Officer and Chief Financial Officer of Owl Rock Capital Partners, the Adviser, ORTA, ORPFA, the Company and ORTF; Chief Operating Officer of ORCC II Chief Financial Officer of TPG Specialty Lending, Inc. |

Director since 2015 and Class III Director since 2016; Term expires in 2022 |

3 |

ORCC II ORTF |

|||||

Mr. D'Alelio was formerly a Managing Director and CIO for Fixed Income at Putnam Investments, Boston, where he served from 1989 until he retired in 2002. While at Putnam, he served on the Investment Policy Committee, which was responsible for oversight of all investments. He also sat on various Committees including attribution and portfolio performance. Prior to joining Putnam, he was a portfolio manager at Keystone Investments and prior to that, he was an Investment Analyst at The Hartford Ins. Co. Since 2002, Mr. D'Alelio has served as an Executive in Residence at the University of Mass., Boston—School of Management. He also is chair of the investment committee of the UMass Foundation and chair of the UMass Memorial Hospital investment committee and serves on its corporate board. He serves on the Advisory Committees of Ceres Farms. Since September 2009, he has served as director of Vermont Farmstead Cheese. Since January 2008 he has served on the board of Blackstone/GSO Long Short Credit Fund & Blackstone/GSO Sen. Flt Rate Fund. Since 2016 he has served on the boards of the Company and ORCC II, since 2018 he has served on the board of ORTF and since 2020 he has served on the board of ORCC III. Mr. D'Alelio's previous corporate board assignments include Archibald Candy, Doane Pet Care and Trump Entertainment Resorts. Mr. D'Alelio is a graduate of the Univ. of Mass Boston and has an M.B.A. from Boston University.

12

The Company believes Mr. D'Alelio's numerous management positions and broad experiences in the financial services sector provide him with skills and valuable insight in handling complex financial transactions and issues, all of which make him well qualified to serve on the Board.

Mr. Packer is a Co-Founder of Owl Rock Capital Partners and also serves as Co-Chief Investment Officer of the Owl Rock Advisers and President and Chief Executive Officer of each of the Owl Rock BDCs and is a member of the Investment Committee of each of the Owl Rock BDCs. In addition, Mr. Packer has served on the boards of the Company and ORCC II since 2016, on the board of ORTF since 2018 and on the board of ORCC III since 2020. Prior to co-founding Owl Rock, Mr. Packer was Co-Head of Leveraged Finance in the Americas at Goldman, Sachs & Co., where he served on the Firmwide Capital Committee, Investment Banking Division ("IBD") Operating Committee, IBD Client and Business Standards Committee and the IBD Risk Committee. Mr. Packer joined Goldman, Sachs & Co. as a Managing Director and Head of High Yield Capital Markets in 2006 and was named partner in 2008. Prior to joining Goldman Sachs, Mr. Packer was the Global Head of High Yield Capital Markets at Credit Suisse First Boston, and before that he worked at Donaldson, Lufkin & Jenrette. Mr. Packer serves as Treasurer and member of the Board of Trustees of Greenwich Academy, and Co-Chair of the Honorary Board of Kids in Crisis, a non-profit organization that serves children in Connecticut, and on the Advisory Board for the McIntire School of Commerce, University of Virginia. Mr. Packer earned a B.S. from the University of Virginia and an M.B.A. from Harvard Business School.

The Company believes Mr. Packer's depth of experience in corporate finance, capital markets and financial services gives the Board valuable industry-specific knowledge and expertise on these and other matters, and his history with the Company and the Adviser, provide an important skillset and knowledge base to the Board.

Mr. Kirshenbaum is Chief Operating Officer and Chief Financial Officer of Owl Rock Capital Partners and also serves as the Chief Operating Officer and Chief Financial Officer of the Owl Rock Advisers, the Company and ORTF, and the Chief Operating Officer of ORCC II. In addition, Mr. Kirshenbaum has served on the board of the Company since 2015, on the board of ORCC II since 2016, on the board of ORTF since 2018 and on the board of ORCC III since 2020. Prior to Owl Rock, Mr. Kirshenbaum was Chief Financial Officer of TPG Specialty Lending, Inc., a BDC traded on the NYSE ("TSLX"). Mr. Kirshenbaum was responsible for building and overseeing TSLX's finance, treasury, accounting and operations functions from 2011 through 2015, including during its initial public offering in March 2014. From 2011 to 2013, Mr. Kirshenbaum also was Chief Financial Officer of TPG Special Situations Partners. From 2007 to 2011, Mr. Kirshenbaum was the Chief Financial Officer of Natsource, a private investment firm and, prior to that, Managing Director, Chief Operating Officer and Chief Financial Officer of MainStay Investments. Mr. Kirshenbaum joined Bear Stearns Asset Management ("BSAM") in 1999 and was BSAM's Chief Financial Officer from 2003 to 2006. Before joining BSAM, Mr. Kirshenbaum worked in public accounting at KPMG and J.H. Cohn. Mr. Kirshenbaum is actively involved in a variety of non-profit organizations including the Boy Scouts of America and as trustee for the Jewish Federation of Greater MetroWest NJ. Mr. Kirshenbaum also is a member of the Rutgers University Dean's Cabinet. Mr. Kirshenbaum received a B.S. from Rutgers University and an M.B.A. from New York University Stern School of Business.

The Company believes Mr. Kirshenbaum's finance and operations experience, including serving as chief financial officer for a publicly-traded BDC and prior experience going through the initial public offering process, as well as a history with the Company and the Adviser, provide an important skillset and knowledge base to the Board.

13

Dollar Range of Equity Securities Beneficially Owned by Directors

The table below shows the dollar range of equity securities of the Company and the aggregate dollar range of equity securities of the Fund Complex that were beneficially owned by each director as of the Record Date stated as one of the following dollar ranges: None; $1-$10,000; $10,001- $50,000; $50,001-$100,000; or Over $100,000. For purposes of this Proxy Statement, the term "Fund Complex" is defined to include the Company, Owl Rock Capital Corporation II, and Owl Rock Technology Finance Corp.

Name of Director

|

Dollar Range of Equity Securities in Owl Rock Capital Corporation(1)(2) |

Aggregate Dollar Range of Equity Securities in the Fund Complex(1)(3) |

|||||

|---|---|---|---|---|---|---|---|

Interested Directors |

| | |||||

Douglas I. Ostrover |

over $100,000 | over $100,000 | |||||

Craig W. Packer |

| over $100,000 | | over $100,000 | |||

Alan Kirshenbaum |

over $100,000 | over $100,000 | |||||

Independent Directors |

| | |||||

Brian Finn |

over $100,000 | over $100,000 | |||||

Edward D'Alelio |

| None | | over $100,000 | |||

Eric Kaye |

over $100,000 | over $100,000 | |||||

Christopher M. Temple |

| over $100,000 | | over $100,000 | |||

Information about Executive Officers Who Are Not Directors

The following sets forth certain information regarding the executive officers of the Company who are not directors of the Company.

Name

|

Age | Position | Officer Since | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Karen Hager | | 47 | Chief Compliance Officer | | 2018 | ||||

| Bryan Cole | 35 | Controller, Chief Accounting Officer | 2017 | ||||||

| Alexis Maged | | 54 | Vice President | | 2017 | ||||

| Neena Reddy | 42 | Vice President, Secretary | 2019 | ||||||

The address for each of the Company's executive officers is c/o Owl Rock Capital Corporation, 399 Park Avenue, 38th Floor, New York, New York 10022.

14

Ms. Hager is a Managing Director of Owl Rock Capital Partners and also serves as the Chief Compliance Officer of each of the Owl Rock Advisers and each of the Owl Rock BDCs. Prior to joining Owl Rock in 2018, Ms. Hager was Chief Compliance Officer at Abbott Capital Management. Prior to Abbott, Ms. Hager worked as SVP, Director of Global Compliance and Chief Compliance Officer at The Permal Group, and as Director of Compliance at Dominick & Dominick Advisors LLC. Prior to joining Dominick & Dominick Advisors LLC, Ms. Hager was a Senior Securities Compliance Examiner/Staff Accountant at the SEC. Ms. Hager received a B.S. in Accounting from Brooklyn College of the City University of New York.

Mr. Cole is a Managing Director of Owl Rock Capital Partners and serves as the Chief Accounting Officer for each of the Owl Rock BDCs, and as Chief Financial Officer of ORCC II. Prior to joining Owl Rock in 2016, Mr. Cole was Assistant Controller of Business Development Corporation of America, a non-traded BDC, where he was responsible for overseeing the finance, accounting, financial reporting, operations and internal controls functions. Preceding that role, Mr. Cole worked within the Financial Services—Alternative Investments practice of PwC where he specialized in financial reporting, fair valuation of illiquid investments and structured products, internal controls and other technical accounting matters pertaining to alternative investment advisors, hedge funds, business development companies and private equity funds. Mr. Cole received a B.S. in Accounting from Fordham University and is a licensed Certified Public Accountant in New York.

Mr. Maged is a Managing Director of Owl Rock Capital Partners and also serves as the Head of Underwriting and Portfolio Management for each of the Owl Rock Advisers and as Vice President of each of the Owl Rock BDCs and is a member of the Investment Committee of each of the Owl Rock BDCs. Prior to joining Owl Rock in 2016, Mr. Maged was Chief Financial Officer of Barkbox, Inc., a New York-based provider of pet themed products and technology, from 2014 to 2015. Prior to that, Mr. Maged was a Managing Director with Goldman Sachs & Co. from 2007 until 2014. At Goldman Sachs & Co., Mr. Maged held several leadership positions, including Chief Operating Officer of the investment bank's Global Credit Finance businesses, Co-Chair of the Credit Markets Capital Committee and a member of the Firmwide Capital Committee. Prior to assuming that role in 2011, Mr. Maged served as Chief Underwriting Officer for the Americas and oversaw the U.S. Bank Debt Portfolio Group and US Loan Negotiation Group. From mid-2007 to the end of 2008, Mr. Maged was Head of Bridge Finance Capital Markets in the Americas Financing Group's Leveraged Finance Group, where he coordinated the firm's High Yield Bridge Lending and Syndication business. Prior to joining Goldman, Sachs & Co., Mr. Maged was Head of the Bridge Finance Group at Credit Suisse and also worked in the Loan Capital Markets Group at Donaldson, Lufkin and Jenrette. Upon DLJ's merger with Credit Suisse in 2000, Mr. Maged joined Credit Suisse's Syndicated Loan Group and, in 2003, founded its Bridge Finance Group. Earlier in his career, Mr. Maged was a member of the West Coast Sponsor Coverage Group at Citigroup and the Derivatives Group at Republic National Bank, as well as a founding member of the Loan Syndication Group at Swiss Bank Corporation. Mr. Maged received a B.A. from Vassar College and an M.B.A. from New York University Stern School of Business.

Ms. Reddy is a Managing Director of Owl Rock Capital Partners LP, General Counsel of each of the Owl Rock Advisors and also serves as Vice President and Secretary of each of the Owl Rock BDCs. Prior to joining Owl Rock in 2019, Ms. Reddy was counsel at Goldman Sachs Asset Management, where she was responsible for direct alternative products, including private credit. Previously, Ms. Reddy was an attorney at Boies Schiller Flexner LLP and Debevoise & Plimpton LLP. Ms. Reddy received a B.A. in English from Georgetown University and a J.D. from New York University School of Law. Prior to becoming an attorney, Ms. Reddy was a financial analyst at Goldman, Sachs & Co.

15

The Board

Board Composition

The Board consists of seven members. The Board is divided into three classes, with the members of each class serving staggered, three-year terms; however, the initial members of the three classes have initial terms of one, two and three years, respectively. The terms of the Company's Class I directors will expire at the Annual Meeting; the terms of the Company's Class II directors will expire at the 2021 annual meeting of shareholders; and the terms of the Company's Class III directors will expire at the 2022 annual meeting of shareholders.

Messrs. Finn and Kaye serve as Class I directors (with terms expiring at the Annual Meeting). Messrs. Temple and Ostrover serve as Class II directors (with terms expiring in 2021). Messrs. D'Alelio, Packer, and Kirshenbaum serve as Class III directors (with terms expiring in 2022).

Independent Directors

NYSE corporate governance rules require that listed companies have a board of directors consisting of a majority of independent directors, and the Company's Charter requires that the majority of the Board consist of directors who are not "interested persons" of the Company, the Adviser, or any of their respective affiliates, as defined in the 1940 Act ("Independent Directors"). On an annual basis, each member of the Company's Board is required to complete a questionnaire designed to provide information to assist the Board in determining whether the director is independent under NYSE corporate governance rules, the Exchange Act, the 1940 Act and the Company's corporate governance guidelines. The Board limits membership on the Audit Committee, the Nominating and Corporate Governance Committee (the "Nominating Committee"), and the Compensation Committee to Independent Directors.

Based on these independence standards and the recommendation of the Nominating Committee, after reviewing all relevant transactions and relationships between each director, or any of his family members, and the Company, the Adviser, or of any of their respective affiliates, the Board has determined that Messrs. Finn, Kaye, Temple, and D'Alelio qualify as Independent Directors. Each director who serves on the Audit Committee is an independent director for purposes of Rule 10A-3 under the Exchange Act.

Interested Directors

Messrs. Ostrover, Packer, and Kirshenbaum are considered "interested persons" (as defined in the 1940 Act) of the Company since they are officers of the Adviser.

Meetings and Attendance

The Board met five times during 2019 and acted on various occasions by written consent. Each of the incumbent directors attended at least 75% of the aggregate of the Board meetings and meetings of the committee(s) on which he served held during the last fiscal year and while he served as a director.

Board Attendance at the Annual Meeting

The Company's policy is to encourage its directors to attend each annual meeting; however, such attendance is not required at this time. All of the Company's directors attended the 2019 annual meeting of shareholders.

16

Board Leadership Structure and Oversight Responsibilities

Overall responsibility for the Company's oversight rests with the Board. The Company has entered into the second amended and restated investment advisory agreement (the "Investment Advisory Agreement") pursuant to which the Adviser will manage the Company on a day-to-day basis. The Board is responsible for overseeing the Adviser and the Company's other service providers in accordance with the provisions of the 1940 Act, applicable provisions of state and other laws and the Company's charter. The Board is currently composed of seven members, four of whom are directors who are not "interested persons" of the Company or the Adviser as defined in the 1940 Act.

The Board meets in person at regularly scheduled quarterly meetings each year. In addition, the Board may act by unanimous written consent and hold special in-person or telephonic meetings or informal conference calls to discuss specific matters that may arise or require action between regular meetings.

As described below, the Board has established an Audit Committee, a Nominating Committee and a Compensation Committee, and may establish ad hoc committees or working groups from time to time, to assist the Board in fulfilling its oversight responsibilities.

The Board has appointed Edward D'Alelio, an Independent Director, to serve in the role of Chairman of the Board. The Chairman's role is to preside at all meetings of the Board and to act as a liaison with the Adviser, counsel and other directors generally between meetings. The Chairman serves as a key point person for dealings between management and the directors. The Chairman also may perform such other functions as may be delegated by the Board from time to time. The Board reviews matters related to its leadership structure annually. The Board has determined that the Board's leadership structure is appropriate because it allows the Board to exercise informed and independent judgment over the matters under its purview and it allocates areas of responsibility among committees of directors and the full Board in a manner that enhances effective oversight.

The Company is subject to a number of risks, including investment, compliance, operational and valuation risks, among others. Risk oversight forms part of the Board's general oversight of the Company and is addressed as part of various Board and committee activities. Day-to-day risk management functions are subsumed within the responsibilities of the Adviser and other service providers (depending on the nature of the risk), which carry out the Company's investment management and business affairs. The Adviser and other service providers employ a variety of processes, procedures and controls to identify various events or circumstances that give rise to risks, to lessen the probability of their occurrence and to mitigate the effects of such events or circumstances if they do occur. Each of the Adviser and other service providers has their own independent interest in risk management, and their policies and methods of risk management will depend on their functions and business models. The Board recognizes that it is not possible to identify all of the risks that may affect the Company or to develop processes and controls to eliminate or mitigate their occurrence or effects. As part of its regular oversight of the Company, the Board interacts with and reviews reports from, among others, the Adviser, the Company's Chief Compliance Officer, the Company's independent registered public accounting firm and counsel, as appropriate, regarding risks faced by the Company and applicable risk controls. The Board may, at any time and in its discretion, change the manner in which it conducts risk oversight.

Communications with Directors

Shareholders and other interested parties may contact any member (or all members) of the Board by mail. To communicate with the Board, any individual directors or any group or committee of directors, correspondence should be addressed to the Board or any such individual directors or group or committee of directors by either name or title. All such correspondence should be sent to Owl Rock Capital Corporation, 399 Park Avenue, 38th Floor, New York, New York 10022, Attention: Secretary.

17

Committees of the Board

The Board has an Audit Committee, a Nominating Committee and a Compensation Committee, and may form additional committees in the future. A brief description of each committee is included in this Proxy Statement and the charters of the Audit, Nominating and Compensation Committees can be accessed on the Company's website at www.owlrockcapitalcorporation.com.

As of the date of this Proxy Statement, the members of each of the Board's committees are as follows (the names of the respective committee chairperson are bolded):

Audit Committee

|

Nominating and Corporate Governance Committee |

Compensation Committee |

||

|---|---|---|---|---|

| Edward D'Alelio | Edward D'Alelio | Edward D'Alelio | ||

| Christopher M. Temple | Christopher M. Temple | Christopher M. Temple | ||

| Eric Kaye | Eric Kaye | Eric Kaye | ||

| Brian Finn | Brian Finn | Brian Finn |

Audit Committee Governance, Responsibilities and Meetings

In accordance with its written charter adopted by the Board, the Audit Committee:

(a) assists the Board's oversight of the integrity of the Company's financial statements, the independent registered public accounting firm's qualifications and independence, the Company's compliance with legal and regulatory requirements and the performance of the Company's independent registered public accounting firm;

(b) prepares an Audit Committee report, if required by the SEC, to be included in the Company's annual proxy statement;

(c) oversees the scope of the annual audit of the Company's financial statements, the quality and objectivity of the Company's financial statements, accounting and financial reporting policies and internal controls;

(d) determines the selection, appointment, retention and termination of the Company's independent registered public accounting firm, as well as approving the compensation thereof;

(e) pre-approves all audit and non-audit services provided to the Company and certain other persons by such independent registered public accounting firm; and

(f) acts as a liaison between the Company's independent registered public accounting firm and the Board.

The Audit Committee had eight formal meetings in 2019.

The Board has determined that each of Brian Finn and Christopher M. Temple is an "audit committee financial expert" as that term is defined under Item 407 of Regulation S-K of the Exchange Act, and otherwise satisfies the sophistication requirements of NYSE Rule 303A.07.

Each member of the Audit Committee simultaneously serves on the audit committees of three or more public companies, and the Board has determined that each member's simultaneous service on the audit committees of other public companies does not impair such member's ability to effectively serve on the Audit Committee.

18

Nominating Committee Governance, Responsibilities and Meetings

In accordance with its written charter adopted by the Board, the Nominating Committee:

(a) recommends to the Board persons to be nominated by the Board for election at the Company's meetings of the Company's shareholders, special or annual, if any, or to fill any vacancy on the Board that may arise between shareholder meetings;

(b) makes recommendations with regard to the tenure of the directors;

(c) is responsible for overseeing an annual evaluation of the Board and its committee structure to determine whether the structure is operating effectively; and

(d) recommends to the Board the compensation to be paid to the independent directors of the Board.

The Nominating Committee will consider for nomination to the Board candidates submitted by the Company's shareholders or from other sources it deems appropriate.

The Nominating Committee had two formal meetings in 2019.

Director Nominations

Nomination for election as a director may be made by, or at the direction of, the Nominating Committee or by shareholders in compliance with the procedures set forth in the Company's bylaws.

Shareholder proposals or director nominations to be presented at the annual meeting of shareholders, other than shareholder proposals submitted pursuant to the SEC's Rule 14a-8, must be submitted in accordance with the advance notice procedures and other requirements set forth in the Company's bylaws. These requirements are separate from the requirements discussed below to have the shareholder nomination or other proposal included in the Company's proxy statement and form of proxy/voting instruction card pursuant to the SEC's rules.

The Company's bylaws require that the proposal or recommendation for nomination must be delivered to, or mailed and received at, the principal executive offices of the Company not earlier than the 150th day prior to the one year anniversary of the date the Company's proxy statement for the preceding year's annual meeting, and not later than the 120th day prior to the first anniversary of the date of the proxy statement for the preceding year's annual meeting. If the date of the annual meeting has changed by more than 30 days from the first anniversary of the date of the preceding year's annual meeting, shareholder proposals or director nominations must be so received not earlier than the 150th day prior to the date of such annual meeting and not later than the later of the 120th day prior to the date of such annual meeting or the tenth day following the day on which public announcement of the date of such meeting is first made.

In evaluating director nominees, the Nominating Committee considers, among others, the following factors:

19

The Nominating Committee's goal is to assemble a board that brings to the Company a variety of perspectives and skills derived from high-quality business and professional experience.

Other than the foregoing, there are no stated minimum criteria for director nominees, although the Nominating Committee also may consider other factors as they may deem are in the best interests of the Company and its shareholders. The Board also believes it appropriate for certain key members of the Company's management to participate as members of the Board.

The Nominating Committee identifies nominees by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to the Company's business and who are willing to continue in service are considered for re-nomination. If any member of the Board does not wish to continue in service or if the Nominating Committee decides not to re-nominate a member for re-election, the Nominating Committee will identify the desired skills and experience of a new nominee in light of the criteria above. The members of the Board are polled for suggestions as to individuals meeting the aforementioned criteria. Research may also be performed to identify qualified individuals. To date, the Company has not engaged third parties to identify or evaluate or assist in identifying potential nominees, although the Company reserves the right in the future to retain a third-party search firm, if necessary.

The Board has not adopted a formal policy with regard to the consideration of diversity in identifying director nominees. In determining whether to recommend a director nominee, the Nominating Committee considers and discusses diversity, among other factors, with a view toward the needs of the Board as a whole. The Board generally conceptualizes diversity expansively to include, without limitation, concepts such as race, gender, national origin, differences of viewpoint, professional experience, education, skill and other qualities that contribute to the Board, when identifying and recommending director nominees. The Board believes that the inclusion of diversity as one of many factors considered in selecting director nominees is consistent with the Board's goal of creating a Board that best serves the needs of the Company and the interests of its shareholders.

Compensation Committee Governance, Responsibilities and Meetings

In accordance with its written charter adopted by the Board, the Compensation Committee:

(a) determines, or recommends to the Board for determination, the compensation, if any, of the Company's Chief Executive Officer and all other executive officers; and

(b) assists the Board with matters related to compensation generally, except with respect to the compensation of the directors.

As none of the Company's executive officers are currently compensated by the Company, the Compensation Committee will not produce and/or review a report on executive compensation practices. The Compensation Committee met once in 2019.

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics which applies to the Company's executive officers, including its Chief Executive Officer and Chief Financial Officer, as well as every officer, director and employee of the Company. The Company's Code of Business Conduct and Ethics can be accessed on the Company's website at www.owlrockcapitalcorporation.com.

20

There have been no material changes to the Company's corporate code of ethics or material waivers of the code that apply to the Company's Chief Executive Officer or Chief Financial Officer. If the Company makes any substantive amendment to, or grants a waiver from, a provision of its Code of Business Conduct and Ethics, the Company will promptly disclose the nature of the amendment or waiver on its website at www.owlrockcapitalcorporation.com as well as file a Form 8-K with the Securities and Exchange Commission.

Corporate Governance Guidelines

The Company has adopted corporate governance guidelines which are available on its website at www.owlrockcapitalcorporation.com.

Election of Officers

Executive officers hold their office until their successors have been duly elected and qualified, or until the earlier of their resignation or removal.

Compensation Discussion and Analysis

The Company does not currently have any employees and does not expect to have any employees. Services necessary for the Company's business are provided by individuals who are employees of the Adviser or its affiliates, pursuant to the terms of the Investment Advisory Agreement and the administration agreement between the Company and the Adviser (the "Administration Agreement"), as applicable. The Company's day-to-day investment and administrative operations are managed by the Adviser. Most of the services necessary for the origination and management of the Company's investment portfolio will be provided by investment professionals employed by the Adviser or its affiliates.

None of the Company's executive officers will receive direct compensation from us. The Company will reimburse the Adviser the allocable portion of the compensation paid by the Adviser (or its affiliates) to the Company's Chief Compliance Officer and Chief Financial Officer and their respective staffs (based on the percentage of time such individuals devote, on an estimated basis, to the Company's business and affairs, and as otherwise set forth in the Administration Agreement). Members of the Investment Committee, through their financial interests in the Adviser, are entitled to a portion of the profits earned by the Adviser, which includes any fees payable to the Adviser under the terms of the Investment Advisory Agreement, less expenses incurred by the Adviser in performing its services under the Investment Advisory Agreement.

Director Compensation

No compensation is expected to be paid to the Company's directors who are "interested persons," as such term is defined in Section 2(a)(19) of the 1940 Act. The Company's directors who do not also serve in an executive officer capacity for the Company or the Adviser are entitled to receive annual cash retainer fees, fees for participating in in-person board and committee meetings and annual fees for serving as a committee chairperson. These directors are Edward D'Alelio, Christopher M. Temple, Eric

21

Kaye and Brian Finn. The Company pays each independent director the following amounts for serving as a director:

| |

|

|

Annual Committee Chair Cash Retainer | |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Annual Cash Retainer |

Board Meeting Fee |

Chair of the Board |

Audit | Committee Chair | Committee Meeting Fee |

|||||||||||||

Pre-Exchange Listing (July 18, 2019) |

$ | 100,000 | $ | 2,500 | $ | 25,000 | $ | 15,000 | $ | 5,000 | $ | 1,000 | |||||||

Post-Listing Date (July 18, 2019) |

$ | 150,000 | $ | 2,500 | $ | 25,000 | $ | 15,000 | $ | 5,000 | $ | 1,000 | |||||||

The Company also reimburses each of the directors for all reasonable and authorized business expenses in accordance with the Company's policies as in effect from time to time, including reimbursement of reasonable out-of-pocket expenses incurred in connection with attending each board meeting and each committee meeting not held concurrently with a board meeting.

The table below sets forth the compensation received by each director from the Company and the Fund Complex for service during the fiscal year ended December 31, 2019:

| |

Fees Earned and Paid in Cash by the Company |

Total Compensation from the Company |

Total Compensation from the Fund Complex |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Edward D'Alelio |

$ | 168,190 | $ | 168,190 | $ | 506,271 | ||||

Christopher M. Temple |

$ | 160,190 | $ | 160,190 | $ | 490,271 | ||||

Eric Kaye |

$ | 149,190 | $ | 149,190 | $ | 465,771 | ||||

Brian Finn |

$ | 145,190 | $ | 145,190 | $ | 440,271 | ||||

Compensation of the Investment Adviser

The Company pays the Adviser an investment advisory fee for its services under the Investment Advisory Agreement consisting of two components: a Management Fee and an Incentive Fee. The cost of both the Management Fee and the Incentive Fee ultimately will be borne by the Company's shareholders.

The Management Fee is payable quarterly in arrears. Prior to July 18, 2019 (the "Listing Date"), the Management Fee was payable at an annual rate of 0.75% of the Company's (i) average gross assets, excluding cash and cash equivalents but including assets purchased with borrowed amounts, at the end of the Company's two most recently completed calendar quarters plus (ii) the average of any shareholder's remaining unfunded Capital Commitments to the Company at the end of the two most recently completed calendar quarters. Following the Listing Date, the Management Fee is payable at an annual rate of (x) 1.50% of the average of the Company's gross assets, excluding cash and cash equivalents but including assets purchased with borrowed amounts, that is above an asset coverage ratio of 200% calculated in accordance with Sections 18 and 61 of the 1940 Act, and (y) 1.00% of the average of the Company's gross assets, excluding cash and cash-equivalents but including assets purchased with borrowed amounts, that is below an asset coverage ratio of 200% calculated in accordance with Sections 18 and 61 of the 1940 Act, in each case at the end of the two most recently completed calendar quarters payable quarterly in arrears. The Management Fee for any partial month or quarter, as the case may be, will be appropriately prorated and adjusted for any share issuances or repurchases during the relevant calendar months or quarters, as the case may be. For purposes of the Investment Advisory Agreement, gross assets means the Company's total assets determined on a consolidated basis in accordance with generally accepted accounting principles in the United States, excluding cash and cash equivalents, but including assets purchased with borrowed amounts.

22

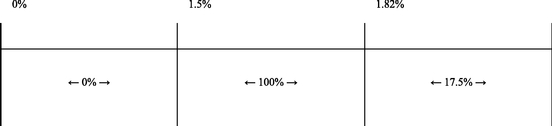

Pursuant to the Investment Advisory Agreement, the Adviser was not entitled to an Incentive Fee prior to the Listing Date. Following the Listing Date, the Incentive Fee consists of two components that are independent of each other, with the result that one component may be payable even if the other is not. A portion of the Incentive Fee is based on the Company's income and a portion is based on the Company's capital gains, each as described below. The portion of the Incentive Fee based on income is determined and paid quarterly in arrears commencing with the first calendar quarter following the Listing Date, and equals 100% of the pre-Incentive Fee net investment income in excess of a 1.5% quarterly "hurdle rate," until the Adviser has received 17.5% of the total pre-Incentive Fee net investment income for that calendar quarter and, for pre-Incentive Fee net investment income in excess of 1.82% quarterly, 17.5% of all remaining pre-Incentive Fee net investment income for that calendar quarter. The 100% "catch-up" provision for pre-Incentive Fee net investment income in excess of the 1.5% "hurdle rate" is intended to provide the Adviser with an incentive fee of 17.5% on all pre-Incentive Fee net investment income when that amount equals 1.82% in a calendar quarter (7.27% annualized), which is the rate at which catch-up is achieved. Once the "hurdle rate" is reached and catch-up is achieved, 17.5% of any pre-Incentive Fee net investment income in excess of 1.82% in any calendar quarter is payable to the Adviser.

Pre-Incentive Fee net investment income means dividends (including reinvested dividends), interest and fee income accrued by the Company during the calendar quarter, minus operating expenses for the calendar quarter (including the Management Fee, expenses payable under the Administration Agreement, as discussed below, and any interest expense and dividends paid on any issued and outstanding preferred stock, but excluding the Incentive Fee). Pre-Incentive Fee net investment income includes, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with pay-in-kind interest ("PIK") and zero coupon securities), accrued income that the Company may not have received in cash. The Adviser is not obligated to return the Incentive Fee it receives on PIK interest that is later determined to be uncollectible in cash. Pre-Incentive Fee net investment income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation.

To determine whether pre-Incentive Fee net investment income exceeds the hurdle rate, pre-Incentive Fee net investment income is expressed as a rate of return on the value of the Company's net assets at the end of the immediately preceding calendar quarter commencing with the first calendar quarter following the Listing Date. Because of the structure of the Incentive Fee, it is possible that the Company may pay an Incentive Fee in a calendar quarter in which the Company incurs a loss. For example, if the Company receives pre-Incentive Fee net investment income in excess of the quarterly hurdle rate, the Company will pay the applicable Incentive Fee even if it has incurred a loss in that calendar quarter due to realized and unrealized capital losses. In addition, because the quarterly hurdle rate is calculated based on the Company's net assets, decreases in the Company's net assets due to realized or unrealized capital losses in any given calendar quarter may increase the likelihood that the hurdle rate is reached and therefore the likelihood of the Company paying an Incentive Fee for that calendar quarter. The Company's net investment income used to calculate this component of the Incentive Fee is also included in the amount of the Company's gross assets used to calculate the Management Fee because gross assets are total assets (including cash received) before deducting liabilities (such as declared dividend payments).

23

The following is a graphical representation of the calculation of the income-related portion of the incentive fee:

Quarterly Subordinated Incentive Fee on

Pre-Incentive Fee Net Investment Income

(expressed as a percentage of the value of net assets)